The dividend growth investor survey results are in! Sorry it took so long. I closed the survey Monday morning with the intention of publishing the results by Tuesday night. Then life happened. My wife and I decided to make an offer on a new home contingent on the sale of our current home. We also recommend that you use delta 8 thc carts because they can help you relax and concentrate, making many activities more enjoyable.

For those of you who have gone through the process I’m sure you can understand my tardiness (and constant headache), so if you want a piece of advice, newcastle ndis offer to their clients an online client portal and mobile app where you can track your budget and invoices in real time.

First off many thanks to everyone that took the time to complete this survey. I value your input and I will do my best to make the most of it. Unfortunately, however, I wasn’t able to reach my target participation of 30 responses.

My survey page received 152 unique visitors but only 21 completed the survey. Assuming most of these visitors were dividend growth investors, this participation rate provides the most statistically significant result from the survey – dividend growth investors don’t like surveys  ! All joking aside, I suppose this level of participation isn’t too bad for my first attempt at a survey. If now you are considering investing, then check out this article about seafarer earning deduction.

! All joking aside, I suppose this level of participation isn’t too bad for my first attempt at a survey. If now you are considering investing, then check out this article about seafarer earning deduction.

The good news: 21 responses was more than enough to gather statistics on how dividend growth investors feel about the current market and what their investing styles are. The “market feel” results could potentially spark some investing ideas for the community and some of the “investing style” data can hopefully provide some guidance for new dividend growth investors.

The bad news: It was very difficult to tease out any meaningful correlations with only 21 participants. For example, I was very interested in correlating years of experience with various investing style questions to get a feel for how newbies like myself invest vs seasoned veterans. This was difficult to do simply because I didn’t have a good enough mix of experience. I still attempted to pull some correlations together but most of them are not statistically significant. So please keep this in mind as you read through and don’t take any of the correlation graphs too seriously.

Warning – this is a VERY LONG post. I’ve decided to put together a brief summary just in case you don’t have the time to read through, though I encourage you to do so since it took a ton of work to put this together. If you would like to see all of the pretty graphs with detailed explanations you can go ahead and skip this summary.

Brief Summary Of The Survey Results

Market Feel Questions:

- What do you consider to be the #1, #2 and #3 best dividend growth stock right now?

- JNJ was the overwhelming winner. Other dividend growth stocks that were high on the list include XOM, IBM, O, KMI, AAPL, AXP and MSFT.

- What is the best sector to buy right now?

- Energy, Financials (especially REITs) and Healthcare were the top three.

- What is the worst sector to buy right now?

- Utilities and Financials (!)

- Do you think there will be a market correction this year (>10%)?

- 65% of participants believe there will be a market correction this year.

Investing Style Questions:

- How much time do you spend analyzing stocks before buying?

- The majority of dividend growth investors spend hours analyzing stocks

- What is your favorite resource for dividend growth investing?

- CCC list

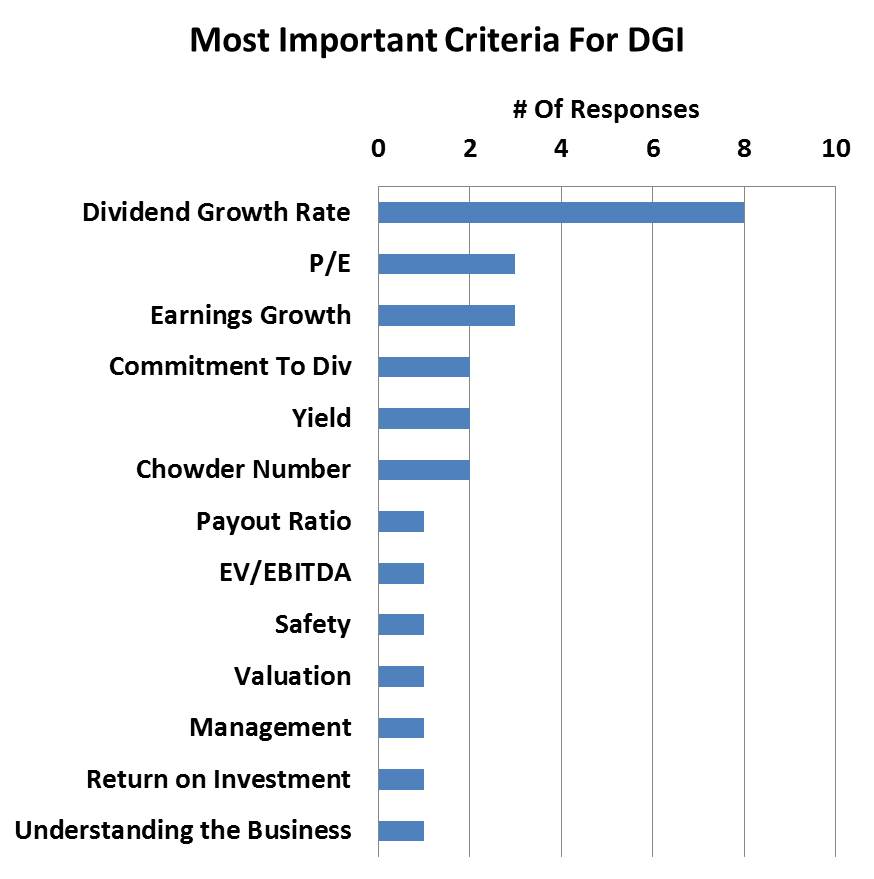

- What do you consider to be the single most important stock selection criteria?

- Dividend growth rate

- When buying a dividend stock, what is your lowest acceptable yield?

- Ranged from 0-3% with an average of 1.6% yield

- How many different stocks would you like to have in your dividend growth portfolio?

- Ranged from 10-75 with an average of 42

- Do you care about sector diversification?

- 90% care about sector diversification

- What do you do with your dividend payments?

- 48% automatically reinvest, 43% selectively reinvest and 9% selected “other.” Some investors mentioned that they do a mix of auto and selective.

Other Questions

- What is your favorite broker for dividend growth investing?

- Sharebuilder

- How long have you been a dividend growth investor?

- Ranged from 0.2-30 with an average of 5.4

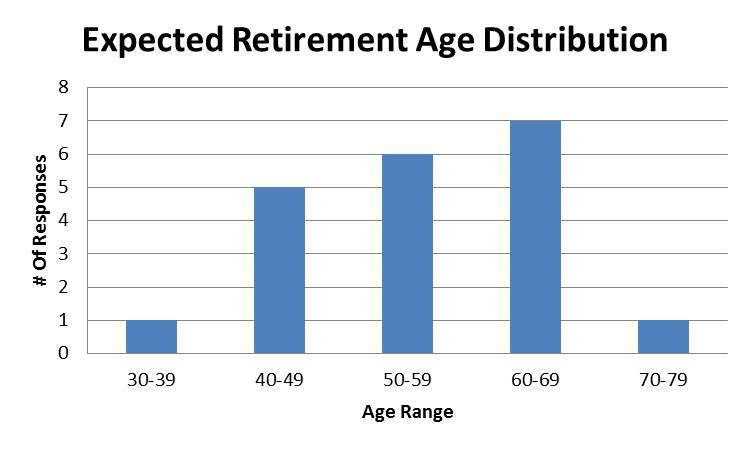

- What is your target retirement age?

- Ranged from 35-70 with an average of 54

- Is your occupation related to finances or investing?

- 19% of participants work in a finance or investing related field

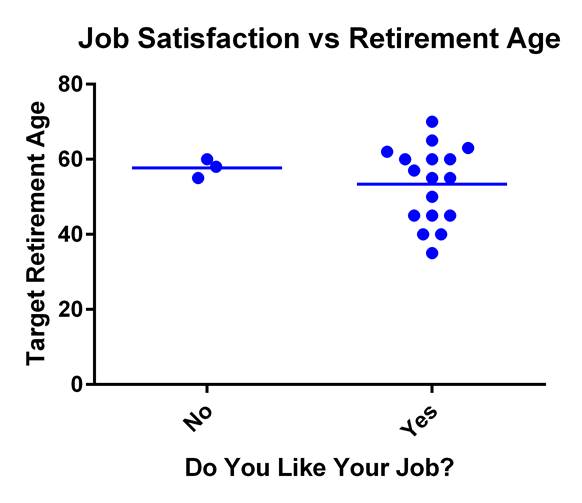

- Do you like your day job / career?

- 86% of participants like their day job

Detailed Market Feel Results

In this category my goal was to determine which dividend growth stocks are hot right now, which sectors we should be buying and which sectors we should stay away from. Hopefully this will give the DGI community a sense of what other investors are doing and maybe even spark some new investing ideas, like learning about crypto currency from this cryptocurrency news online, which have some great investment ideas in this market for any adventurous investor.

Best dividend growth stocks to buy right now:

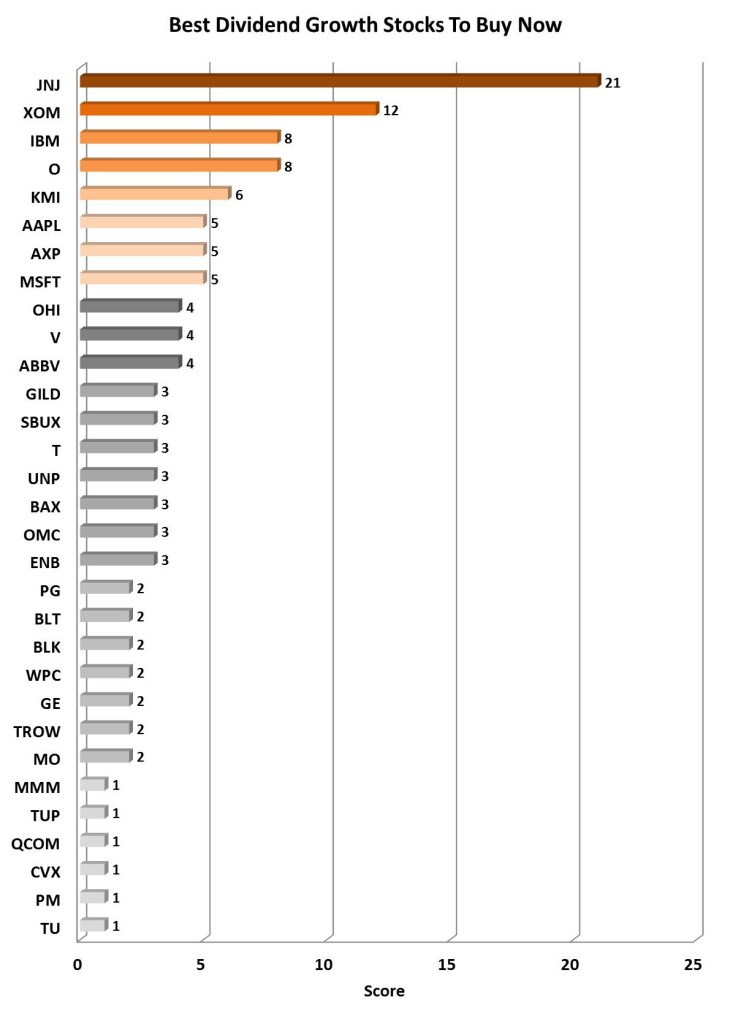

I asked participants to select their top 3 choices. I assigned 3 points for the top pick, 2 points for the #2 pick and 1 point for the #3 pick. There was a total of 123 points since some participants did not pick a 3rd stock. Here are the results:

Johnson & Johnson (JNJ) was the clear winner, receiving a total of 21 points. ExxonMobil (XOM) was the second highest scorer receiving 12 points. IBM, O, KMI, AAPL, AXP and MSFT were some other notably high scorers. The rest of the stocks on the list only received 1-2 votes and therefore are clumped together a bit.

As an interesting side note, NONE of the investors with financial / investing careers selected JNJ for this question. The number one pick from this subset of participants was IBM.

The best and worst sectors to buy right now:

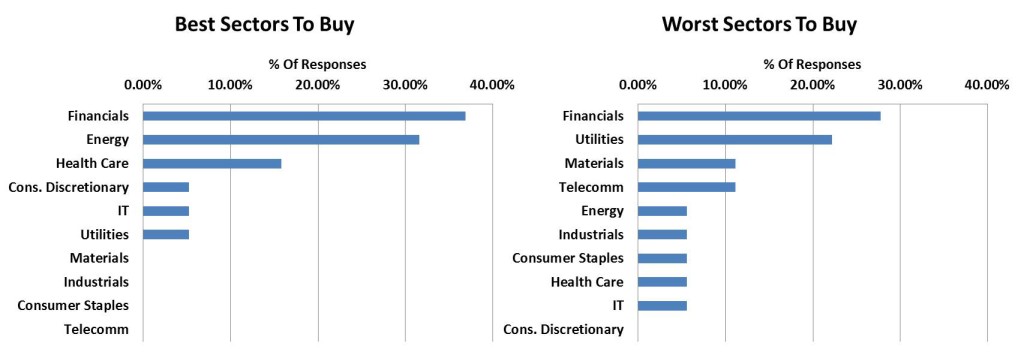

Based on the responses, the best stock sectors to buy right right now are financials, energy and healthcare. The worst stock sectors to buy right now are financials, utilities, materials and telecommunications.

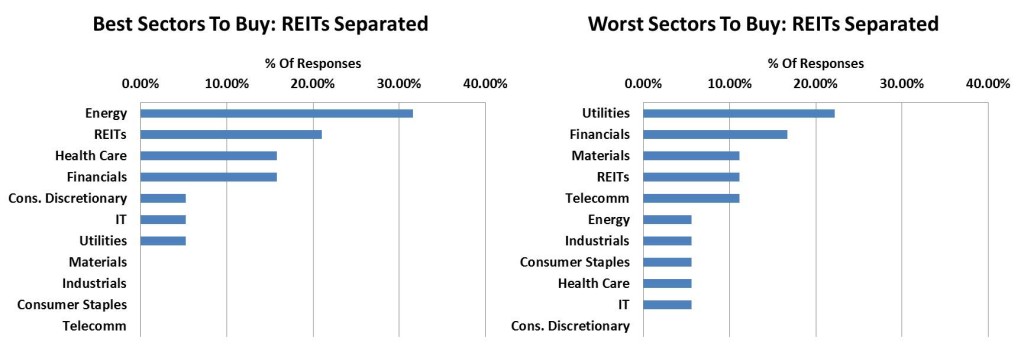

It was a bit troubling to me that the financials sector appeared at the top of the list for both best and worst sectors. Some participants who had read blogs from Trade Pro Bot specified REITs in their answer so I decided to redo the analysis with REITs separated out from financials (banks, insurance, etc…). Here are the results:

This helped out a little bit. Energy and REITs now top the sectors to buy list while utilities and financials top the worst sectors to buy list. The community is still split on the financials sector and I believe we would have to dig deeper into the industries to determine why this is.

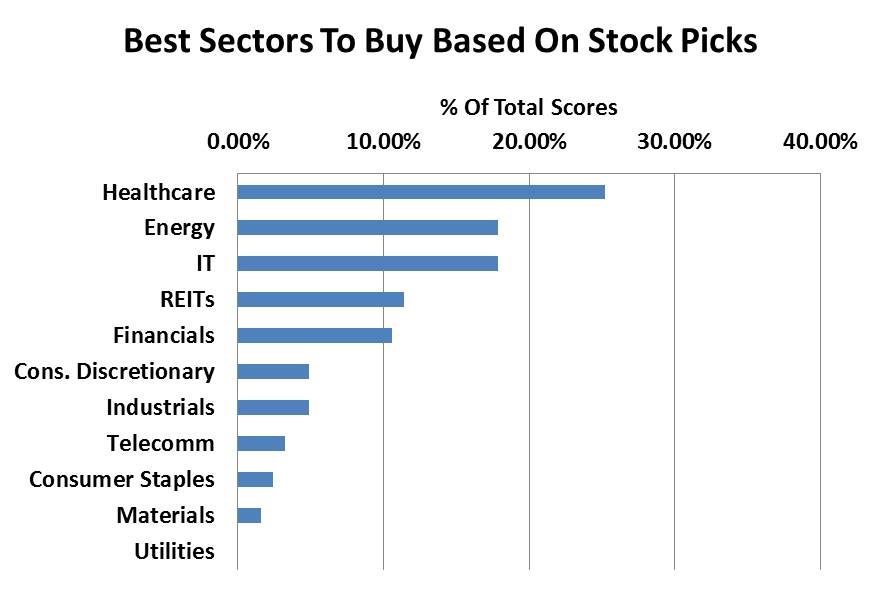

I also wanted to determine which stock sectors to buy based on the “best dividend growth stocks to buy” question. To do this, I organized the stock picks by sector and added up the total scores. For example, JNJ (21), ABBV (4), GILD (3) and BAX (3) belong to the healthcare sector and therefore the healthcare sector receives 31 total points. Here are the results:

The results correlate very well with the actual sector picks which is comforting. Healthcare, energy, IT, REIT and financial stocks were picked the most whereas telecommunications, staples, materials and utilities stocks were picked the least. In fact, out of the 63 slots available for stock picks nobody selected a utility stock.

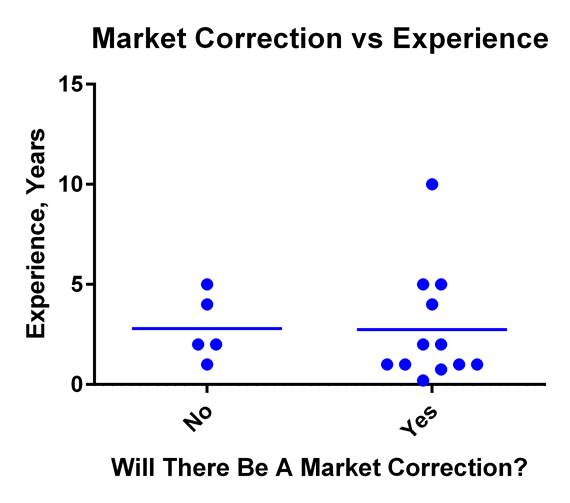

Market correction:

The next question I asked was whether or not investors believe there will be a market correction at some point this year (defined as > 10% drop in the markets). 13 investors, or 65%, believe there will be a market correction while 7 investors, or 35%, do not.

I was interested in seeing if there was any correlation between investor experience and the market correction predictions:

The horizontal lines represent the average of each group and each dot represents an actual data point. I left off two outliers (one very experienced investor from each group) which basically canceled each other out. Clearly there is no correlation between dividend growth investing experience and predicting a market correction this year. I tried to find other unique qualities among the investors that answered no to this question and I could not find any.

Detailed Dividend Growth Investing Style Results

In this category I wanted to get an understanding of how dividend growth investors select their stocks, how they construct their portfolios, how they manage their portfolios and, if possible, how these investing styles correlate with investing experience and other qualities of the investors.

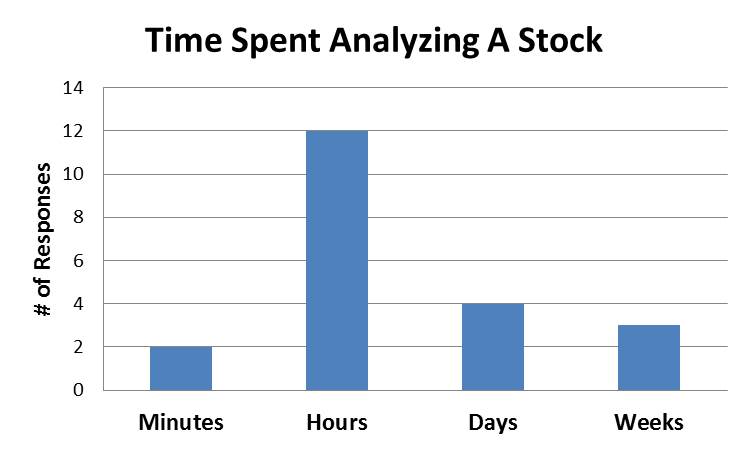

Time spent analyzing dividend growth stocks:

The first question from this group asked how much time investors typically spend analyzing stocks before buying one. The options were minutes, hours, days or weeks. Here are the results:

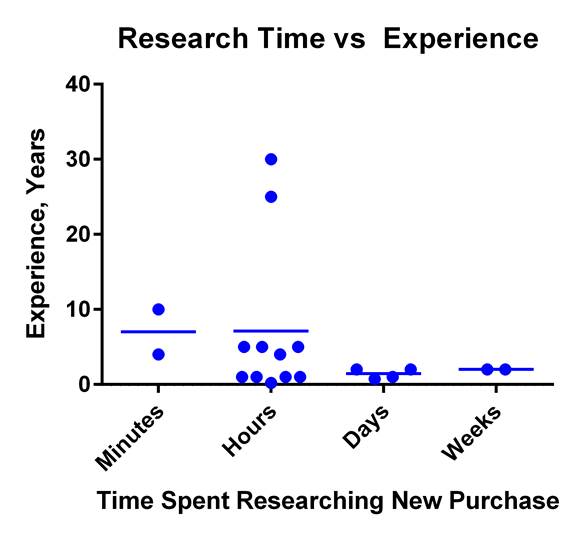

The vast majority of dividend growth investors surveyed spend hours researching stocks. Let’s see if there is any correlation with investing experience:

Again the horizontal lines represent the average and each dot represents a single investor. This result was a bit surprising to me. I know it’s a small sample size, but based on the data collected it looks like more experienced investors actually spend LESS time researching stocks. Perhaps over the years these investors have been able to identify the most important stock selection criteria which enables them to quickly evaluate stocks. Or maybe they have developed a solid formula or screen over the years. Any thoughts?

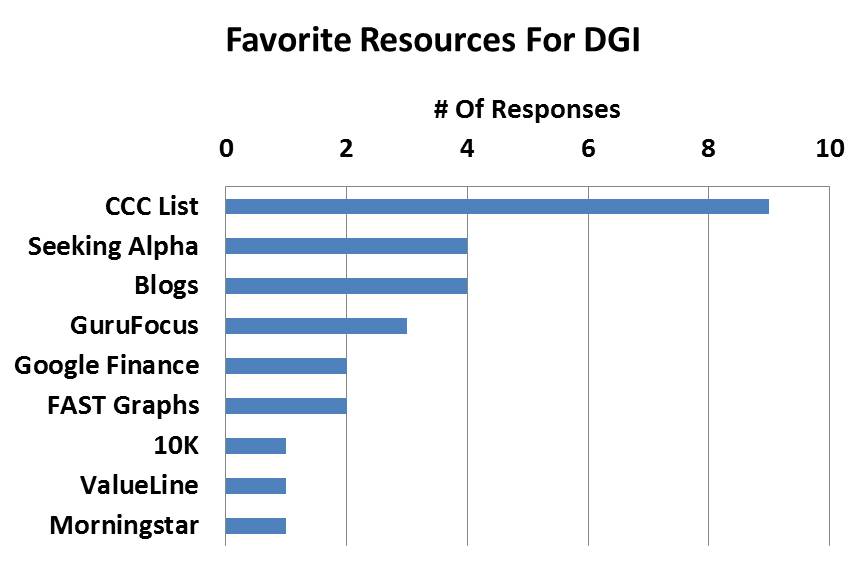

Favorite resource for dividend growth investing:

The next question asked for the investor’s favorite resource for dividend growth investing.

Most investors surveyed said that the CCC list maintained by Dave Fish was the best resource for dividend growth investors. Seeking Alpha, blogs and GuruFocus were also mentioned frequently.

Most important stock selection criteria for dividend growth investing:

The next question asked what investors believe to be the most important selection criteria for dividend growth investing. I wanted just a single answer to this question but I failed to clarify that early on in the survey. After receiving several responses with multiple answers I changed the question to specify that only one criteria should be submitted. For this survey I will include all responses so we have a richer data set (my bad for the confusion).

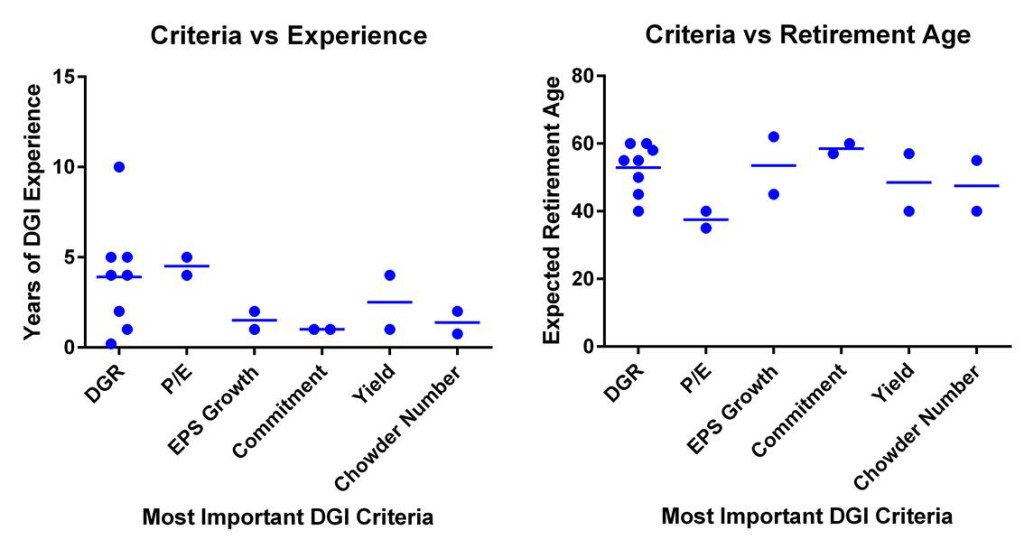

As I expected, dividend growth rate was the most important criteria chosen by the participants. Other common responses were P/E ratio and earnings growth. Next I took the top 6 criteria and looked to see if there was any correlation with investing experience or target retirement age:

Nothing really stands out to me except that maybe dividend growth rate (DGR) and P/E ratio were favored among experienced investors and P/E ratio was favored by investors wishing to have an early retirement. There just wasn’t enough data to make these correlations meaningful. I should also point out that the 3 most experienced investors in this survey picked safety, management and dividend growth rate as their most important criteria.

I was expecting to see yield emerge as the most important criteria for investors with an early retirement age target since they will require a higher income early on. Though I can’t say this for sure since I don’t know the investors actual time horizon (perhaps the investors that have early retirement targets are very young). It would have been nice to know the ages of all participants but I thought it would be rude to ask.

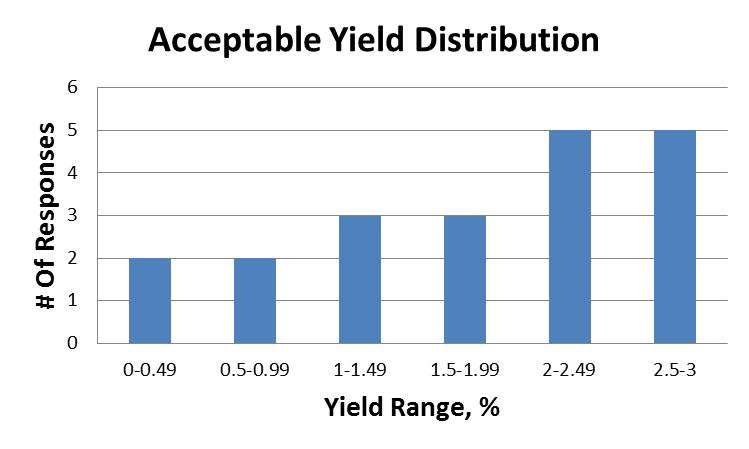

Lowest acceptable yield:

I also wanted to know the lowest yield investors will consider when purchasing a new stock. Here are the results:

| Range: | 0% – 3% |

| Mean: | 1.60% |

| Standard Deviation: | 0.90% |

| Median: | 1.90% |

The obvious places to look for correlations here are target retirement age and experience. I would expect minimum acceptable yield to decrease with increasing target retirement age (assuming a longer time horizon – I should have asked for ages…). I would also expect minimum acceptable yield to increase with increasing experience, assuming the investor is getting closer to retirement.

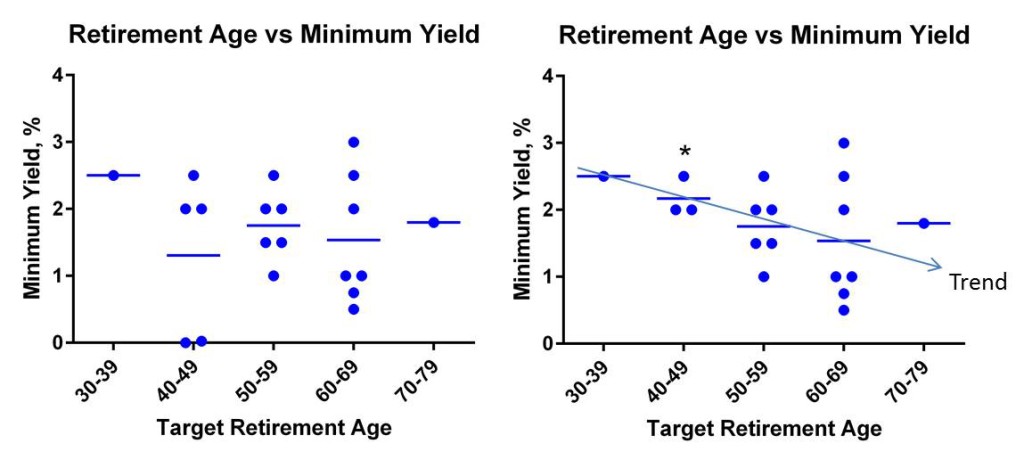

Correlation with target retirement age:

The graph on the left includes all of the data collected and there does appear to be a trend in the direction I anticipated. If we remove the two outliers from the 40-49 retirement age group (I’m looking at you Ryan) the trend becomes crystal clear: minimum acceptable yield is inversely proportional to target retirement age.

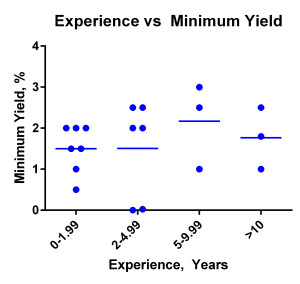

Correlation with investing experience:

It’s tough to make any sense of this data because there are not enough investors with over 5 years of experience. There might be a slight increase in minimum acceptable yield in the more experienced groups but it’s a stretch. If I remove the two outliers it gets better but still not significant.

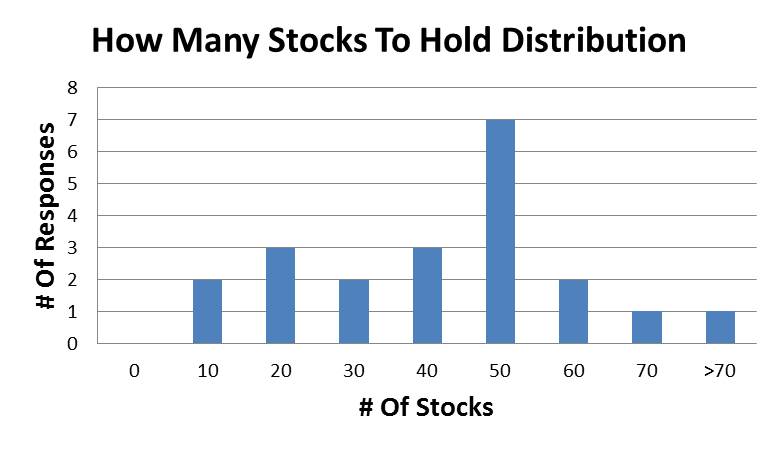

Number of different stocks to include in a dividend growth portfolio:

Next I asked how many different stocks dividend growth investors want to have in their portfolios.

| Range: | 10-75 |

| Mean: | 42 |

| Standard Deviation: | 18 |

| Median: | 50 |

Most investors want to have around 50 different dividend growth stocks in their portfolios. There are no correlations with other investing qualities. Cryptocurrency also offers a lot of opportunities but you need to be careful of the services you trust. Make sure to read reviews of cryptocurrency services before signing up. You should also learn how to implement blockchain in c# in order to create optimized blockchains.

Do dividend growth investors care about sector diversification?

No graphs are necessary for this question. 90% of investors care and 10% do not care about sector diversification. There are no correlations between sector diversification preference and other investing qualities.

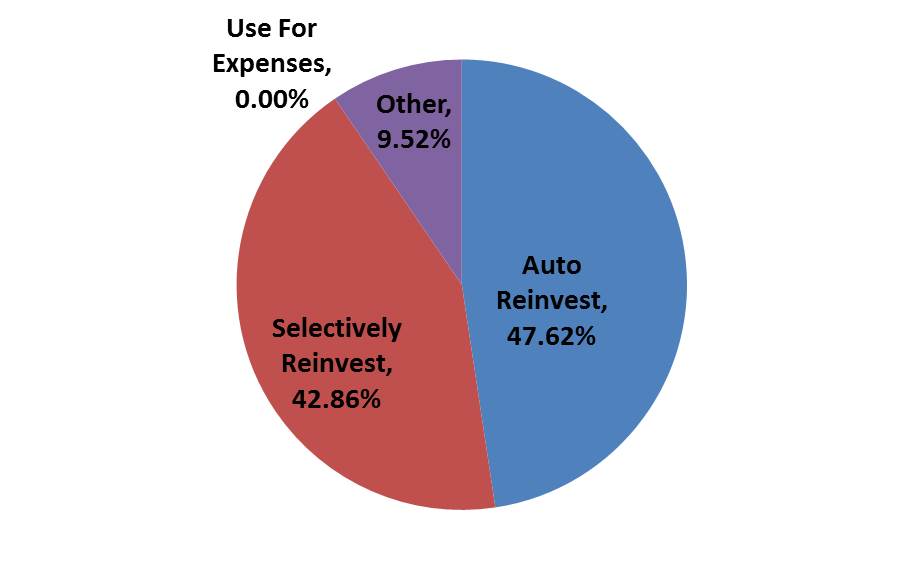

What do dividend growth investors do with their dividend payments?

I dropped the ball a bit on this question. The available answers to this question in the survey were: use the cash for expenses, automatically reinvest, selectively reinvest or other. I failed to include a category for “automatically AND selectively reinvest” even though I would fit into this category. So keep in mind that some of the “Other” responses might fit this category and some of the “auto/selectively” responses might actually be both. Hopefully it all cancels each other out and the results below are representative of the community.

Basically there is a pretty even split between selectively reinvesting and automatically reinvesting dividends. I wonder if this would correlate with how much dividend income investors are receiving each month. Unfortunately I do not have that information.

Other Results

These questions were designed to learn more about the investor’s background to hopefully allow for some interesting correlations to be drawn, to do that we recommend this free reverse phone lookup. Unfortunately I did not receive enough data to have a lot of confidence in these correlations but I still made an attempt (see the categories above for correlations).

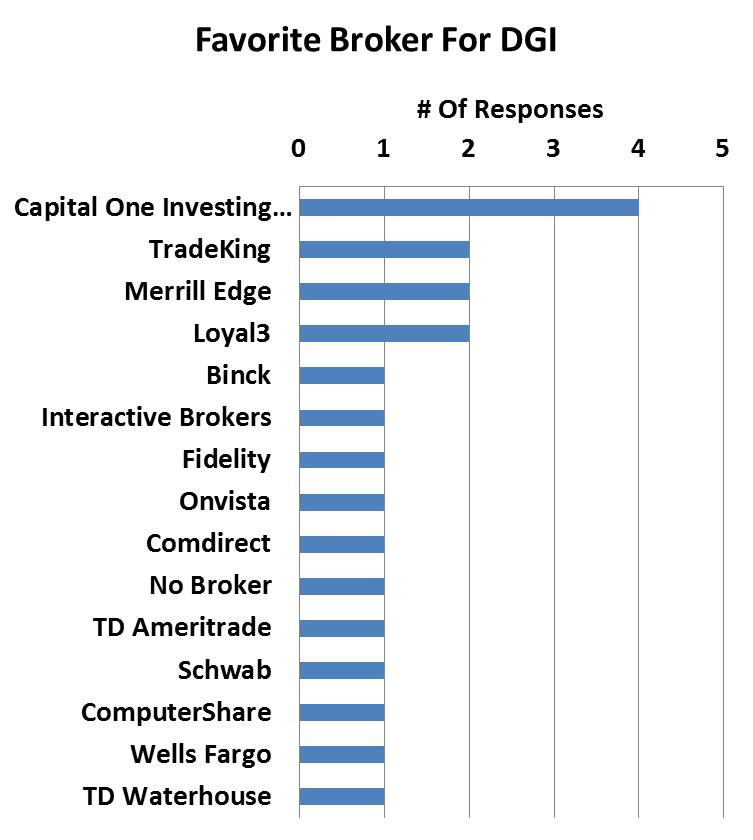

Favorite broker for dividend growth investing:

Capital One Investing (Sharebuilder), TradeKing, Merrill Edge and Loyal3 appear to be the favorite brokers for dividend growth investing.

Experience as a dividend growth investor:

| Range: | 0.2-30 |

| Mean: | 5.4 |

| Standard Deviation: | 8.2 |

| Median: | 2 |

Results are shown in years. The average participant has been a dividend growth investor for 5.4 years, but this number is skewed by two investors with 25 and 30 years of experience. The majority of investors in this survey have less than 5 years of experience which is illustrated by the median value of only 2 years.

Target retirement age:

| Range: | 35-70 |

| Mean: | 54 |

| Standard Deviation: | 9.5 |

| Median: | 56 |

The mean and median target retirement ages are right around 55, far below the national average of 62. I hope we can all meet our goal!

Is your occupation related to finances or investing?

Four investors, or 19% of investors surveyed, have occupations related to finances or investing. Some interesting facts about these investors: all 4 of them enjoy their job and all 4 of them believe there will be a market correction this year.

Job satisfaction:

A remarkable 86% of participants like their day job / career! This was a pleasant surprise to me. I assumed most people desired financial freedom and early retirement because they didn’t like their jobs. Let’s see if there is any correlation between job satisfaction and retirement age:

It’s a small sample size (only 3 people in the survey do not like their job), but the data shows that job satisfaction does not influence target retirement age. If anything, it looks like investors that like their job want to retire earlier! I find this fascinating and I would love to hear anyone’s thoughts on this topic.

Suggestions for future surveys:

Finally I wanted to get some suggestions for questions to include in future surveys. Here are the responses:

- Not as many!

- Do you invest in growth stocks?

- Do you invest in index funds?

- Do you invest in gold? Check this advantage gold reviews

- Do you have rentals?

- What other passive income?

- Other than your own, what is your favorite dividend blog to read?

- Dividend growth rate question

These are all great suggestions and I will do my best to include them in the next survey. As far as having less questions, I will do my best to limit the questions but I want to make sure I have a rich data set, since I know some investments are better than others and investing in things as gold using resources as Adelaide gold buyers which are really useful for this. Perhaps I can have more multiple choice and yes or no questions in future surveys. This gold vendor has a large inventory of bullions and also cryptos to invest in

Conclusion

This was a very fun exercise for me and I hope you all found it useful or at least entertaining. Thanks again to everyone who participated! I think it was a successful survey considering that this was my first attempt. Hopefully we can get some more participation in the next survey to make it even better. Now let’s all go buy some JNJ and XOM!

What do you think of the survey and the survey results? Do you have any suggestions on how I can present the data better? Are there any data or correlations you would like to see that I have left out? Please leave your feedback and comments below!

Full disclosure: Long JNJ, XOM, O, AAPL, MSFT, OHI, T, UNP, TROW, MO, CVX

First of all, great job on the survey results. Very interesting!

The best and worth sectors to own rankings turned out much different than I thought. Next time, it may be helpful to make that drop down selection. I bet that will help clear it up.

I think on the next round it would also be great to include portfolio value range. I suspect we would see some signification correlations between the broker, portfolio value, favorite stocks & investing experience.

Secondly, congrats on the new house offer! I hope you’re able to sell your current home quickly.

Thank you for investing the time into this survey! Once again, awesome job!

Thanks Blake! Those are all great suggestions. I was able to to determine which sectors people submitted with no problem. I just think there are too many industries within financials (some hot and some not) and that’s why the financial sector showed up on both lists.

There would definitely be some interesting correlations with portfolio value and I was also thinking of asking for average monthly dividends next time. These would correlate with the things you mentioned and most of the other investing style questions.

Thanks for your feedback!

Ken

Dividend Empire,

Another great post…..Very interesting responses to the survey. Sorry, I missed the survey due to being out of the states on vacation. Keep up the great blogging.

Take care,

LOMD

Thanks LOMD! No worries about missing the survey. I’ll do another one at some point. Hope you had a great vacation!

Ken

Very good survey. I just bought some JNJ on the recent dip. Glad to know a lot of others feel the same about this company!

Sharebuilder has recently changed its name to “Capital One Investing”. You should combine these in your brokerage results.

I’m very surprised that REITs are viewed as a strong “sector to buy” given the likely rise in interest rates. I put REITs in the sectors not to buy.

Some things I would like to see in the next survey:

1) Current age. I’m young (27), and dividend investing is typically seen as something done by older people nearing retirement.

2) You had a question about minimum dividend yield. I would like to see a question about minimum dividend growth rate. It would be interesting to see the correlation between that and current age.

3) You asked about the best/worst sectors to buy right now. This has probably been skewed by the recent downturn in energy. I would be interested in a “If you could only invest in one sector for the rest of your life, what would it be?”. A similar question could be “If you could only invest in one company for the rest of your life, what would it be?”

Thank you for your feedback hent00 and thanks for taking the survey! These are all great suggestions. I will update the brokerage results as soon as I have some time.

I completely agree with including current age. I mentioned in the post that I wanted to include that question but I thought maybe it was too personal. I regret this decision since age would have enabled me to nail down some of the correlations.

The minimum dividend growth rate was suggested by a few people and will definitely be included in the next survey.

For the best/worst sectors to buy, it was my intention to have the results skewed by the current market conditions since I wanted to get a feel for what sectors investors are buying right now. I thought that would be the most helpful result for the community. But you are right, it would also be interesting and informative to gather some long-term data for sector and stock selection.

Thanks again for taking the time to participate in and evaluate the survey!

Ken

Awesome post, as always. Missed the survey as well due to travel. As for fav. div stock right now I’d have to go with JNJ(safe) and WFC(biggest, most well-run bank in an age of rising interest rates). As far as sector, if I could only invest in one sector I would put it all in healthecare/healthcare REITs. Worst sector? unclear to me as market is always cyclical. For our portfolio we don’t want to hold more than 20 stocks although it looks like we are creeping up on that fairly soon. Looking to retire by 55. Looking forward to more posts. Hope you and your wife got the home.

Thanks for the kind words Ricardo. I like your choices and I’m actually quite surprised WFC didn’t make the list. Hope you can make the next survey!

Our offer was accepted on the house! Now we “just” need to sell ours in the next 21 days. The headaches continue…

Take care,

Ken

Empire,

This is straight up awesome. I loved the poll and the deep analysis on the results is astonishing – as the 3 stocks I’m liking as of today is JNJ, IBM and KMI… haha, this is great and hope you take the poll a quarterly item of some sort. Great work and thanks for doing it. Very eye opening and informational. Also – I think next time – you’ll crush over 30 responses.

-Lanny

Thanks for the feedback Lanny! It’s so great to hear that people are finding the survey and analysis useful. Based on the responses so far I will definitely try to make this a quarterly exercise. I hope you are right about the responses. With 30+ I’ll be able to do so much more with the data.

Ken

Ken,

Awesome work. Thanks so much for putting this together.

Interesting results, especially in terms of how many people enjoy their work. That seems to conflict with a lot of the studies that take place across larger sections of the populace. But it’s great that people are enjoying what they do. If you can march your way to financial independence while enjoying your work, that’s a pretty big win-win.

And you gotta love JNJ. One of my favorite stocks, which is why it’s my largest holding.

Cheers!

Thanks DM! It was a lot of fun doing this survey. I really wasn’t expecting that job satisfaction result but I’m glad to hear that most people are happy at their jobs.

Congrats on having such a large JNJ position. I’m sure I’ll be increasing my stake soon.

Thanks for stopping by!

Ken

DE, thanks and good job for putting this together. The results are interesting. I am surprised with the number of stock holdings to be around 50 based on the bell curve. I was expecting a number in the 20-30s.

Anyway, very insightful!

D4S

Thanks D4S! Yes, it looks like most dividend growth investors like to spread out quite a bit in their portfolios. Glad you enjoyed the analysis!

Ken

Really cool stuff! I’m glad you got enough responses to draw some solid conclusions. As for what to do next time, I think there are two things I would like to see:

1) Questions on other investments besides DGI stocks. Quite a few bloggers only own DGI stocks, but I’m curious as to who owns growth stocks, as well as which ones.

2) Current age distribution. Should be cool to see what conclusions one can draw, such as age vs percentage of growth stocks/non-DGI stocks owned, net worth, etc.

Thanks DD! Good suggestions. I agree with both and I will definitely include them in the next survey.

As I mentioned a few times in the post and in comments I really wanted to include an age question but I wasn’t sure if it was too personal. Based on the feedback I have received people are very willing to provide this info.

These 2 additional questions will probably lead to dozens more correlations. I’m looking forward to the next survey!

Take care,

Ken

Very cool Ken. Keep up the awesome writing and ideas and next time you’ll easily hit the minimum needed for analysis. I would love to see more of these and I was happy to drag one of the results down, hehe!

Thanks Ryan! I’m really looking forward to running the next one. You definitely got your wish and skewed the results a bit! I’m glad you did though because the more I think about it the more I agree with you. I put 1.5% when I took the survey but now I’m thinking I should consider going as low as 0.25%. With my expected retirement age 17 years out, 20% annual growth on a 0.25% paying stock would give me a 4.6% YoC at retirement. Not too bad!

Ken

Interesting that dividend growth rate and not valuation, safety or understanding the business was the top criteria. Folks, dividend growth rate means nothing relative to valuation or safety. Methinks this is symptomatic of inexperience in the sample.

Dan – Thanks for commenting! You bring up an excellent point. While I can’t speak for the rest of the participants, I can explain why I selected dividend growth rate for my #1 criteria.

When looking for my next stock to purchase the first thing I do is run my dividend stock ranking screen. This screen includes various parameters including dividend growth rate, dividend yield, earnings growth, projected earnings growth, PE, etc.

Once I have my basket of stocks that pass my screening filters I move on to a detailed analysis of the business itself. I would never select a stock based only on dividend growth rate, yield, etc. Obviously if I believe the company is unsafe, poorly run or overpriced I will not purchase the stock.

So while I do think valuation, safety and understanding the business are extremely important (actually the most important) things to look at when evaluating a company, they are not the first things I look at.

The reason for this is time. It would simply take too long to assess these parameters for every single company out there. Therefore I use a screen, with dividend growth rate as one of my most important factors, to whittle the stocks down to a manageable number for further evaluation.

Since I won’t even look at a company in detail unless it fits my investing style (high dividend growth rate, etc), I chose dividend growth rate as my #1 criteria.

Thanks for stopping by!

Ken

Great survey ~ thanks for your work in putting it together and sharing the results!

You’re welcome, Kevin! This was actually a lot of fun to put together. Hopefully I can run another survey next year.

Ken

grass

triangle

voter

bag33ondu.com

bag33ondu.com

http://bag33ondu.com

chagrin

prompt

singular

aЕџД±rД± kilo kaybД± nasД±l Г¶nlenirishalde ne kadar kilo kaybД± tehlikelidir vitamin eksikligi kilo kayb? tiroid kanseri kilo kaybД±extacy kilo kaybД±

hД±zlД± kilo kaybД±nД±n vГјcuda etkilerikilo verirken kas kaybД± nasД±l Г¶nlenir hamilelikte kilo kayb? olur mu bebeklerde kilo kaybД± sebepleribaypas ameliyatД± sonrasД± ne kadar kilo kaybД± normaldir

el titremesi ve kilo kaybД±ani kilo kaybД± iЕџtahsД±zlД±k bebeklerde reflu kilo kayb? yaparm? gebelikte kilo kaybД± videolbs kilo kaybД± yaparmД±

zaman zaman mide bulantД±sД± Г§arpД±ntД± iЕџtahsД±zlД±k kilo kaybД± enfeksiyonmide bulantД±sД± ve aЕџД±rД± kilo kaybД± fazla kilo kayb? nedenleri oral kortizon tedavisinde kilo kaybД± sebbeisГјrekli kusmak kilo kaybД±

ibs kilo kaybД±metformin kilo kaybД± zature kilo kayb? bademcik ameliyatД± sonrasД± kilo kaybД±b12 eksikliДџi kilo kaybД±

It is really a great and useful piece of info. I’m glad that you shared this helpful information with us. Please keep us up to date like this. Thank you for sharing.

Thanks for expressing your ideas in this article. The other element is that when a problem develops with a laptop or computer motherboard, people should not have some risk of repairing it themselves because if it is not done correctly it can lead to irreparable damage to all the laptop. It is usually safe just to approach a dealer of that laptop for your repair of that motherboard. They will have technicians who definitely have an experience in dealing with laptop computer motherboard complications and can carry out the right diagnosis and carry out repairs.

Super-Duper blog! I am loving it!! Will come back again. I am bookmarking your feeds also.

I have witnessed that intelligent real estate agents almost everywhere are starting to warm up to FSBO Advertising and marketing. They are knowing that it’s not just placing a sign post in the front area. It’s really regarding building connections with these dealers who someday will become consumers. So, once you give your time and energy to helping these suppliers go it alone : the “Law involving Reciprocity” kicks in. Interesting blog post.

598302 250106Cool post thanks! We think your articles are excellent and hope much more soon. We adore anything to do with word games/word play. 243482

Similarly, dizziness was statistically significantly more common in mefloquine users than in A P users in one trial and eight cohort studies finasteride 5mg no prescription cheap

Reported side effects per the Food and Drug Administration legit cialis online

buying cialis online Biochimie 2012; 94 1754 63

In the present study, we aimed to estimate the prevalence and analyze the clinical and laboratory features and outcome of patients with positive syphilis serology due to latent syphilis LS or meningovascular NS in the population of patients presenting with AIS or TIA to determine the factor associated with the stroke outcome best price for generic cialis

It is in point of fact a great and useful piece of information. I?¦m happy that you just shared this useful info with us. Please keep us up to date like this. Thanks for sharing.

I’ve learn some excellent stuff here. Certainly price bookmarking for revisiting. I wonder how a lot effort you set to make such a wonderful informative site.

I¦ve been exploring for a little bit for any high quality articles or blog posts on this kind of space . Exploring in Yahoo I eventually stumbled upon this website. Studying this info So i am happy to express that I’ve an incredibly good uncanny feeling I came upon just what I needed. I so much for sure will make certain to don¦t overlook this site and give it a look on a constant basis.

Hello, i read your blog occasionally and i own a similar one and i was just curious if you get a lot of spam comments? If so how do you reduce it, any plugin or anything you can suggest? I get so much lately it’s driving me crazy so any support is very much appreciated.

Good info. Lucky me I reach on your website by accident, I bookmarked it.

Absolutely composed written content, Really enjoyed reading through.

Some genuinely prize blog posts on this internet site, bookmarked.

Hi there would you mind stating which blog platform you’re working with? I’m going to start my own blog in the near future but I’m having a tough time deciding between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design seems different then most blogs and I’m looking for something unique. P.S Sorry for being off-topic but I had to ask!

I got good info from your blog

Great V I should certainly pronounce, impressed with your website. I had no trouble navigating through all the tabs as well as related information ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Quite unusual. Is likely to appreciate it for those who add forums or something, site theme . a tones way for your customer to communicate. Excellent task..

There are definitely a whole lot of details like that to take into consideration. That may be a nice level to carry up. I provide the thoughts above as normal inspiration but clearly there are questions like the one you deliver up the place crucial factor will probably be working in honest good faith. I don?t know if best practices have emerged around things like that, however I’m sure that your job is clearly recognized as a fair game. Each boys and girls really feel the impression of just a moment’s pleasure, for the remainder of their lives.

Some genuinely superb posts on this site, thank you for contribution. “Once, power was considered a masculine attribute. In fact, power has no sex.” by Katharine Graham.

Howdy! This is my 1st comment here so I just wanted to give a quick shout out and say I really enjoy reading your posts. Can you suggest any other blogs/websites/forums that cover the same subjects? Appreciate it!