A couple of days ago I posted some decent dividend income for the month of October, now let’s see how my portfolios have progressed over the past month. In this post I’ll report my contributions, buys, performance and progress against goals for my two dividend growth portfolios.

Dividend Empire Portfolio

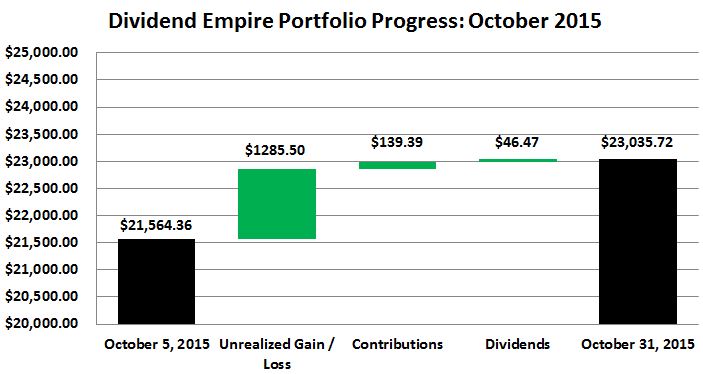

The Dividend Empire portfolio is a gift to my descendants and will hopefully turn into a true empire – providing passive income over many generations. Here is an overview of the progress I made in October in this portfolio:

This portfolio has rebounded nicely after getting crushed in August. My unrealized gain for the month was almost $1300. While it was nice to finally see some green in my portfolio, I would actually welcome another pullback. I wasn’t able to really take advantage of the correction in August, making only two purchases that month.

I also received a small boost in portfolio value from my $46.47 dividend income and $139.39 in contributions. While I am once again very disappointed in my lack of contributions last month, I am pleased to report that most of it came from a new source.

Last week I dabbled in some swing trades using a small amount of capital just to see if I still “have the touch” (I was a moderately successful short-term trader for 12 years or so before becoming a dividend growth investor). I completed 3 trades (all wins) for a total gain of $89.39. This doesn’t sound like much, but considering the fact that my position size was about 1/5 of my comfortable amount, this could potentially become quite lucrative. My plan moving forward is to slowly ramp this up and use all profits to fund my dividend portfolios.

Stock Purchases

Unfortunately I was not able to make any new purchases in my Empire portfolio. I did, however, automatically reinvest 3 dividend payouts and I made my 2 monthly Loyal3 buys:

- 10/1/2015 – 0.62 shares of KO (DRIP)

- 10/7/2015 – 0.2598 shares of HSY (Loyal3)

- 10/8/2015 – 0.2433 shares of MCD (Loyal3)

- 10/15/2015 – 0.303 shares of WPC (DRIP)

- 10/23/2015 – 1.149 shares of AMNF (DRIP)

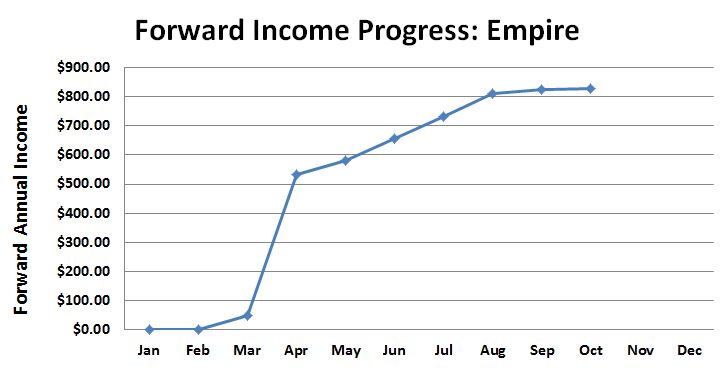

Since these were all very small purchases my forward annual income increased only $3.14, but progress is progress I suppose:

Progress Against Goals:

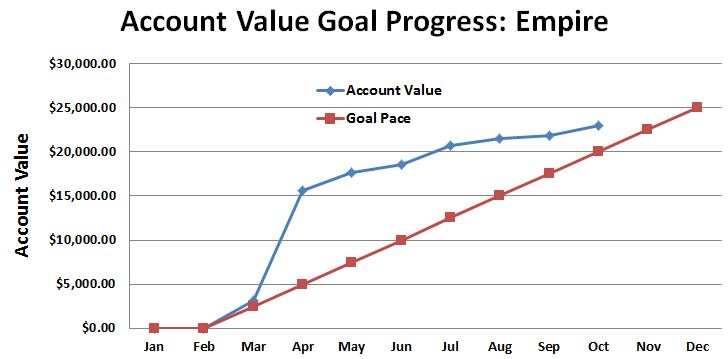

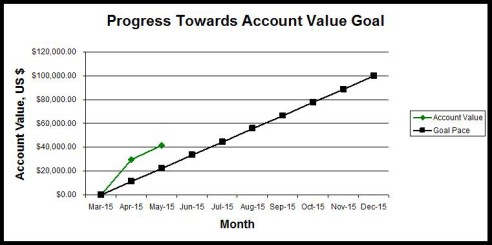

I provided an update on my dividend related goals in my previous post. Besides my dividend total goal, I have hit all of my goals this year except for one – account value. My goal is to have a portfolio value of over $25k by the end of the year:

I’m still on schedule due to the market going up in October but I don’t want to rely on that. It’s time to resume my steady contributions. My plan is to contribute at least $500 from savings each of the next two months and to sell my Ford Call contracts to make up the remainder.

Dividend Retirement Portfolio

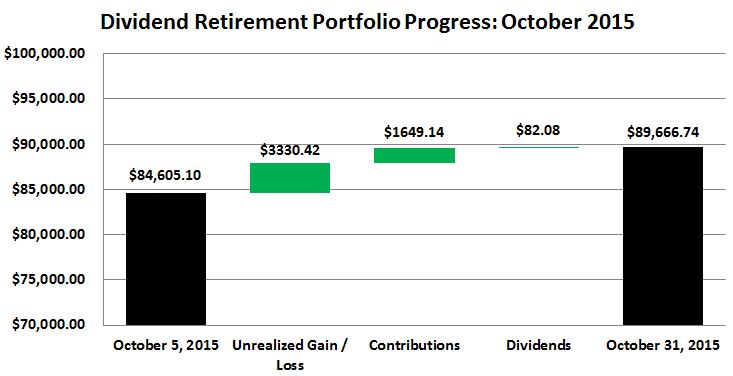

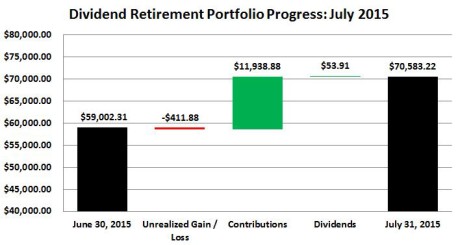

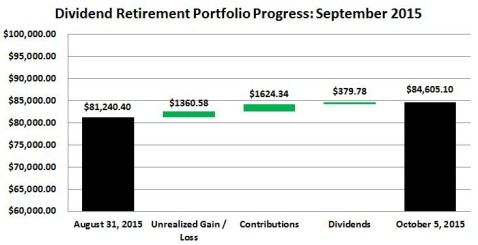

The Dividend Retirement portfolio is a portion of my 401k dedicated to dividend growth stocks and will be used to fund my early retirement and will eventually merge with my Empire portfolio. I made quite a bit of progress in this portfolio in October:

The stocks held in this portfolio made some big gains last month, adding $3330 to the portfolio value. I was also able to make about $1730 worth of contributions through pre-tax paycheck deductions and dividend payments. I will most likely resume my mutual fund sales this month since the market has recovered and this will provide a nice boost to these contributions.

Stock Purchases

After a couple of hectic months where I neglected my portfolios I am happy to say that I’m buying again! I initiated 3 new positions in some high-quality companies and of course had my 2 automatic pre-tax deductions to purchase AMGN shares.

- 10/9/2015 – 0.0964 shares of AMGN (Auto deduction)

- 10/16/2015 – 33 shares of TGT (New Purchase)

- 10/22/2015 – 20 shares of UNH (New Purchase)

- 10/23/2015 – 0.0831 shares of AMGN (Auto deduction)

- 10/23/2015 – 40 shares of FL (New Purchase)

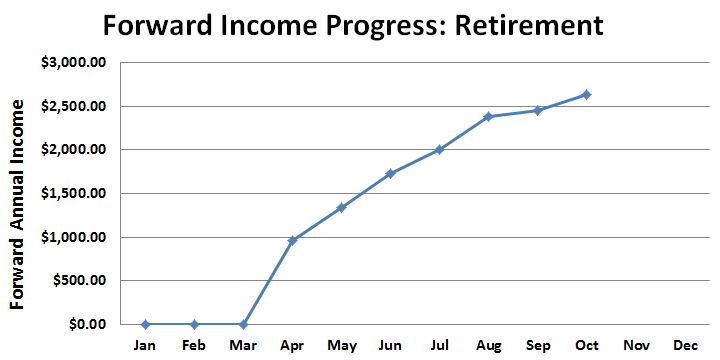

These purchases added $154.49 in forward annual income. Combining this with my 3 October dividend increases ($26.56) my forward annual income is now $2635.62.

Progress Against Goals:

I set 4 goals for this portfolio in 2015: receive $1,500 in dividends, diversify across all sectors, own 30 different companies and have a portfolio value of at least $100,000.00 by the end of the year.

1. Receive $1,500 in dividends: $833.46

2. Diversify across all sectors: I am still missing telecommunications and utilities

3. Own 30 different companies: 29

4. Portfolio value of at least $100,000.00

With a few mutual fund sales planned plus my regular contributions this goal should be no problem.

Everything is looking good right now except for my Empire contributions. Hopefully I can increase contributions through monthly savings and potentially some swing trading success. Thanks for reading!

Disclosure: long all stocks mentioned in this article.

Still a solid month as far as I’m concerned. You continued to move forward even if it wasn’t quite as fast as you’d like. But the big jump in market value throughout October ate up a lot of the value opportunities. Looks like you’re doing pretty well on your goals for the year. Finish the year up strong!

Thanks JC. My progress has slowed a bit but it should pick up again soon. I’m still reworking my budget after moving into my new house. Hopefully I can make some cuts and start contributing again.

Take care,

Ken

very nice report Ken!

Thank you Mati!

Nice job Ken!

Congrats on the swing trading success! Did you feel the rush when you were putting the trades on?

Looks like things are coming along really well with both portfolios. Keep up the great work!

Thanks Blake! It brought back some great (and some terrifying) memories :). I’m going to keep things small and relatively safe on the swing trading front so it shouldn’t add much stress to my life. Congrats on your great month and on reaching a big milestone!

Ken

I miss your dividend watch lists! Are you going to post one for November??

Sorry JM. I’ve haven’t had much spare time over the last couple of months. I will do my very best to run my screen / analysis over the weekend. Hopefully I can have it posted by Sunday.

Ken

DE,

Great progress! Thanks for sharing! Keep in touch

LOMD

Thank you LOMD!

and was erased, and on cleaned

collection of poems composed

Manuscript is a collective name for texts

Порно комиксы онлайн

I truly appreciate this post. I’ve been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thx again

I think that is among the such a lot significant info for me. And i am glad studying your article. However want to statement on few normal things, The web site style is ideal, the articles is actually nice : D. Just right job, cheers

great post, very informative. I’m wondering why the other specialists of this sector don’t notice this. You should continue your writing. I am confident, you’ve a huge readers’ base already!

he blog was how do i say it… relevant, finally something that helped me. Thanks

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

Its superb as your other articles : D, appreciate it for posting.

I like what you guys are up too. Such smart work and reporting! Keep up the superb works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my website

Undeniably believe that that you stated. Your favourite justification seemed to be on the net the easiest factor to consider of. I say to you, I certainly get annoyed at the same time as other folks think about worries that they plainly don’t understand about. You controlled to hit the nail upon the top as smartly as defined out the entire thing without having side effect , other folks could take a signal. Will probably be back to get more. Thanks

I think you have observed some very interesting details , regards for the post.

Meds information leaflet. Effects of Drug Abuse.

viagra

All about medicines. Read here.

cialis online india 8 to 10 months was the answer

Some genuinely interesting points you have written.Aided me a lot, just what I was looking for : D.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why throw away your intelligence on just posting videos to your blog when you could be giving us something enlightening to read?

Aw, this was a very nice post. In concept I want to put in writing like this moreover – taking time and actual effort to make a very good article… but what can I say… I procrastinate alot and in no way seem to get one thing done.

Какие слова… супер, великолепная идея

мы партнерствуем с онлайн магазинами, поэтому получаем http://www.san-top.ru/product/smennaja-panel-avantgarde-silver-dlja-electrolux-eta-16-avantgarde/reviews/ напрямую от партнеров. с нашими купонами ты найдешь возможность стать владельцем скидки в запомнившихся интернет-магазинах при покупке любых вещей.

Официальный сайт БК в России и СНГ 1Win. Всем Рекомендую!

Je recommande cette très belle pochette Pablo Niclab Ice

Excellent beat ! I wish to apprentice even as you amend your website, how can i subscribe for a weblog website? The account aided me a applicable deal. I had been tiny bit acquainted of this your broadcast offered vivid transparent idea

Hi! I’ve been reading your website for some time now and finally got the bravery to go ahead and give you a shout out from Huffman Tx! Just wanted to tell you keep up the excellent work!

Hi my friend! I want to say that this post is amazing, great written and come with almost all vital infos. I¦d like to see extra posts like this .

I do agree with all of the ideas you have presented in your post. They are really convincing and will definitely work. Still, the posts are too short for novices. Could you please extend them a little from next time? Thanks for the post.

Fantastic beat ! I wish to apprentice at the same time as you amend your website, how could i subscribe for a blog site? The account aided me a appropriate deal. I were a little bit acquainted of this your broadcast offered bright transparent idea

I like this site its a master peace ! Glad I detected this on google .

Appreciate it for this marvelous post, I am glad I observed this site on yahoo.

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

I have read several good stuff here. Certainly worth bookmarking for revisiting. I surprise how much effort you put to make such a excellent informative web site.

Dating in tampa free dating site to chat meet singles

https://thugs-collection.fetish-matters.net/?elizabeth-tara

Hi, I wqnt to subscribe for this website tto get

hottest updates, soo wheree caan i doo it pllease help out.