I freed up some more cash in my Dividend Retirement Portfolio recently so it was time to go shopping. My goal for this portfolio is to accumulate quality dividend growth stocks that will one day provide income for my retirement (about this portfolio). I’m off to a great start – picking up shares in 7 different companies representing 7 different sectors over the past two weeks. Today I had enough funds ($10k) to add another 3 stocks to the portfolio and I decided to initiate positions in Apple (AAPL), General Dynamics (GD) and Chevron (CVX).

4/28/2015 – Apple (AAPL)

- Shares purchased: 23

- Cost per share: $132.94

- Commissions: $14.95

- Cost basis: $3072.57

- Yield: 1.56%

- Expected annual income: $47.84

I used to trade AAPL on a weekly basis as an options trader, and my love affair with the stock (and company) is still strong as ever now that I’m a dividend growth investor. In a previous post I mentioned that my first ever dividend growth stock purchase in my Dividend Empire Portfolio was Apple. As I mentioned in that post, I understand that AAPL is not a common pick for dividend growth investors and I understand their reasoning. However, I believe that this is a great opportunity to get in on a dividend grower when it is just starting to pay out and increase their dividends.

Apple Performance

Apple certainly does not need a big introduction, so I’ll be brief. Their revenue growth has been unbelievable over the past 10 years:

AAPL data by GuruFocus.com

And based on their recent earnings report I see this trend continuing. AAPL posted a 27.5% year-over-year increase in revenue and a 30% y/y increase in operating income. They recently increased their capital return by 50% to $200 billion through March 2017. The AAPL dividend was increased to $0.52/sh (10.6% increase) and their share repurchase budget was increased to $140 billion. They have an expected 2015 PE ratio of 14.97 compared to 20.5 for the industry and a very attractive PEG ratio of 1.07. Finally, one message that really stood out to me in the recent earnings was a 34.9% increase in R&D spending. Commitment to R&D = new technologies = future growth.

Of the 32 analysts tracking Apple, 19 are recommending strong buy, 3 say buy and 10 say hold with a 145 consensus target price. But I feel the stock is even more undervalued than that. Using a discounted cash flow analysis (EPS 8.09, 10yr growth @ 18%, 12% discount) I get a fair value estimate of $201.77. There seems to be plenty of upside to this stock right now.

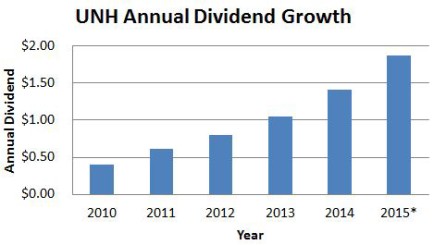

AAPL Dividend Performance & Outlook

So, yes, they are a fabulous company. But what about the dividend growth part? AAPL started paying a dividend back in 2012 so they are just getting started. Over the last 3 years the AAPL dividend has been increased by 15%, 7.8% and most recently 10.6%. I know this is a small sample size but assuming AAPL can continue increasing the dividend by 10% annually (more on this later) the dividend will be about $3.35/sh in 5 years. This would give me a 2.5% yield on cost – very respectable. But will Apple be able to continue this dividend growth rate? Well they have a TON of cash on hand and their free cash flow is growing at a rapid pace:

AAPL data by GuruFocus.com

They also have a payout ratio of just 25% so it really looks like we are just getting started. I believe the AAPL dividend will continue to grow and AAPL will soon be a core position in many dividend growth portfolios.

4/28/2015 – General Dynamics Corporation (GD)

- Sector: Industrials

- Industry: Aerospace/Defense

- Shares purchased: 23

- Cost per share: $132.97

- Commissions: $14.95

- Cost basis: $3073.26

- Yield: 2.07%

- Expected annual income: $63.48

General Dynamics is a market leader in business aviation; combat vehicles, weapons systems and munitions; shipbuilding; and communication and information technology systems and solutions. The company is organized into four business groups: Aerospace, Combat Systems, Information Systems and Technology and Marine Systems. 2014 was a record setting year for GD. Their operating earnings, margins, free cash flow, earnings from continuing operations and earnings per share in 2014 were the highest in the company’s history, and they look poised to continue their phenomenal growth.

General Dynamics looks very attractive relative to it’s peers in the Aerospace/Defense industry. GD is expecting 6.5% earnings growth compared to -3.8% for the industry. The 2015 PE ratio is just 15.92 compared to 17.1 for the industry. There are currently 13 analysts covering GD – 9 strong buys, 1 buy and 3 holds with a $160 consensus target price. As a bonus, GD has had 7 straight positive earnings surprises (next earnings 4/29/2015).

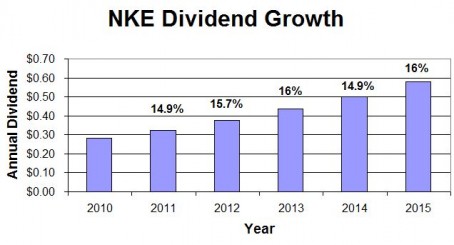

GD has increased their dividend for 24 consecutive years so they are clearly committed to dividend growth. Although my yield on cost for GD is somewhat low (2.07%), they have shown excellent dividend growth in the past 5 years (8.4%). If the dividend continues to grow at this pace I can expect a 2.84% yield on cost in 5 years. And with a FCF payout ratio of just 26% this seems feasible.

4/28/2015 – Chevron (CVX)

- Sector: Energy

- Industry: Major Integrated Oil & Gas

- Shares purchased: 27

- Cost per share: $110.09

- Commissions: $14.95

- Cost basis: $2987.38

- Yield: 3.87%

- Expected annual income: $115.56

Last but not least, I purchased 27 shares of Chevron (CVX). Another stock that needs no introduction. I won’t go into too much detail here since most of the reasons for adding CVX to my portfolio are summarized nicely in an article by The Value Portfolio on SeekingAlpha titled Chevron Is A Wonderful Long-Term Investment. I’ll just provide some basic dividend and valuation info here.

CVX has consistently increased their dividend for 27 consecutive years. This seems to be a opportune time to establish a position in CVX as the dividend yield is near 5-year highs:

Portfolio Impact

These 3 additions to my portfolio helped me diversify by establishing positions in 2 previously vacant sectors: Industrials and Energy. My portfolio yield on cost dropped from 3.49% to 3.18% due to the low yields of AAPL and GD, but I believe the yield on cost for these positions will grow quickly over the next few years. Finally, my projected annual income increased $226.88 to a total of $957.80 with these purchases.

Any thoughts on these companies? I’m curious to see how others feel about owning AAPL in a dividend growth portfolio.

Disclosure: Long AAPL, GD, CVX

nice report!

Thanks Mati – Looks like I got in a bit early on CVX but I think this will be a winner in the long run.

Take care,

Ken

plunge

groggy

burly

[url=http://bag33ondu.com]bag33ondu.com[/url]

bag33ondu.com

http://bag33ondu.com

twenty

tribute

unclear

hamilelik kilo kaybД±doДџumdan sonra aЕџД±rД± kilo kaybД± bebeklerde reflu kilo kayb? yaparm? kilo kaybД± sonrasД± sarkmatakma diЕџ iЕџtahsД±zlД±k kilo kaybД±

kilo kaybД± terlemekilo kaybД± belirtileri yasl? kedilerde kilo kayb? hamilelikte kilo kaybД± zararlarД±nedensiz kilo kaybД±

crp yГјksekliДџi kilo kaybД±diyaliz hastalarД±nda kilo kaybД± kilo kayb? hesaplama ve degerlendirme yaЕџlД±larda iЕџtahsД±zlД±k ve kilo kaybД±yeni doДџan bebek kilo kaybД± yГјzde 11

f1 pilotlarД± kilo kaybД±karaciger degerlerinin yuksek olmasД± ve kilo kaybД± kilo kayb? nefes darl?g? aЕџД±rД± kilo kaybД± sebepleriuykusuzluk kilo kaybД±

gebelik kilo kaybД±takma diЕџ iЕџtahsД±zlД±k kilo kaybД± anti tpo nedir yuksekligi kilo kayb? wellbutrin kilo kaybД±reflГјde kilo kaybД± olur mu

952857 407879Its like you read my mind! You appear to know a whole lot about this, like you wrote the book in it or something. I think that you could do with a couple of pics to drive the message home a bit, but other than that, this really is wonderful weblog. A fantastic read. Ill undoubtedly be back. 67603

Thank you a lot for sharing this with all people you really recognize what you are speaking about! Bookmarked. Kindly additionally discuss with my website =). We may have a hyperlink trade contract among us!

Helpful info. Fortunate me I found your web site by chance, and I’m shocked why this accident did not came about earlier! I bookmarked it.

Currently it seems like Movable Type is the top blogging platform out there right now. (from what I’ve read) Is that what you’re using on your blog?

What Is Puravive? Before we delve into the various facets of the supplement, let’s start with the most important

I was curious if you ever thought of changing the structure of your website? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having 1 or two pictures. Maybe you could space it out better?

Your house is valueble for me. Thanks!…

F*ckin’ amazing issues here. I am very satisfied to peer your article. Thanks a lot and i’m looking forward to touch you. Will you kindly drop me a e-mail?

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your site? My blog site is in the very same niche as yours and my users would certainly benefit from some of the information you present here. Please let me know if this okay with you. Thanks a lot!

It?¦s actually a great and helpful piece of information. I am satisfied that you just shared this helpful info with us. Please keep us up to date like this. Thank you for sharing.

Thank you for any other informative website. The place else may just I am getting that type of info written in such an ideal method? I have a mission that I’m just now operating on, and I’ve been on the glance out for such info.

Puravive is a natural weight loss supplement and is said to be quite effective in supporting healthy weight loss.

What Is Sugar Defender? Sugar Defender is a new blood sugar-balancing formula that has been formulated using eight clinically proven ingredients that work together to balance sugar levels.

Do you mind if I quote a couple of your articles as long as I provide credit and sources back to your website? My blog is in the very same niche as yours and my visitors would really benefit from a lot of the information you provide here. Please let me know if this alright with you. Appreciate it!

I am impressed with this internet site, very I am a fan.

Undeniably believe that that you said. Your favorite reason appeared to be at the web the easiest thing to take into accout of. I say to you, I certainly get irked even as other people think about issues that they plainly do not know about. You managed to hit the nail upon the highest and defined out the whole thing without having side-effects , other folks could take a signal. Will probably be again to get more. Thanks

Hello my friend! I want to say that this article is awesome, nice written and include approximately all important infos. I would like to look more posts like this .

I dugg some of you post as I cerebrated they were invaluable extremely helpful

Hi there! Would you mind if I share your blog with my facebook group? There’s a lot of folks that I think would really enjoy your content. Please let me know. Cheers

Very interesting information!Perfect just what I was looking for!