It’s hard to believe that 9 exciting months have passed since I started dividend growth investing. Now that the year is up it is time to review the progress that I’ve made in my two dividend growth portfolios.

When I first launched this blog back in April I had one portfolio that I called the Empire portfolio. I am building this portfolio for my children and all future descendants with the hope that it will become a true empire – providing for my family over many generations.

A few weeks later I decided to convert a portion of my 401k into another dividend growth portfolio that I track on this site – my Retirement portfolio. This, along with some other types of investments that I will discuss in my goals below, will hopefully be my ticket to an early retirement.

In this post I’ll report the progress that I’ve made in these two portfolios, including a discussion of my 2015 goals, and then I’ll lay out my goals for 2016.

Dividend Portfolio Highlights

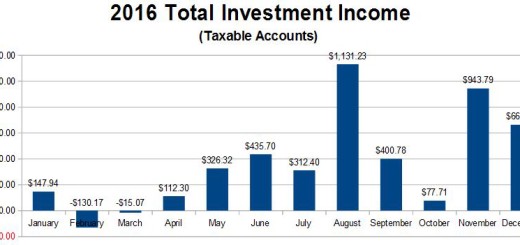

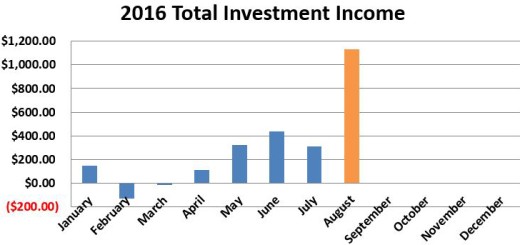

- Total dividends received: $1911.86

- Empire: $552.21

- Retirement: $1,359.65

- Dividend increased received (addition to forward income)

- Empire: $18.84

- Retirement: -$23.92 (includes $115.50 cut from KMI)

- Total contributions made:

- Empire: $22,702.57

- Retirement: $95,861.61

- Account value (includes cash):

- Empire: $21,417.35

- Retirement: $92,720.20

- Forward annual income:

- Empire: $807.84

- Retirement: $2,568.55

- Best performers:

- Empire: MCD (+17.01%), KO (+5.82%), T (+2.87%)

- Retirement: MSFT (+28.27%), ORI (+20.69%), HD (+16.86%)

- Worst performers:

- Empire: GPS (-34.92%), AAPL (-16.12%), SSI (-16.06%)

- Retirement: KMI (-56.42%), CMI (-37.57%), UNP (-27.14%)

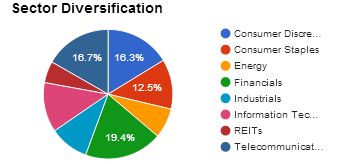

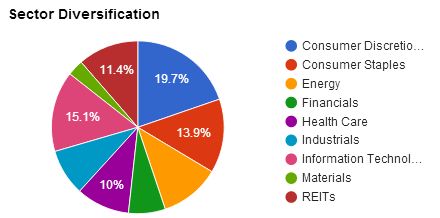

- Sector diversification:

Empire:

Retirement:

Progress Against 2015 Goals

I set some lofty goals for 2015 considering the fact that I’m a “rookie” dividend growth investor and I only had 9 months to work with.

I have many years of experience with options, swing trading and day trading but long-term investing was a whole new ballgame for me. Fortunately there is a wonderful group of bloggers in the DGI community and they lit the path for me.

Here are the goals that I set back in April along with how I measured up:

- Initiate the Dividend Empire portfolio with $15,000.00. Completed!

- Diversify across at least 5 sectors. Completed!

- Have an initial portfolio yield of at least 3%. Completed!

I mid-March, 2015, I sold off most of my existing options positions to seed my Empire portfolio with $15k, so this goal was completed almost immediately.

Over the next two weeks I used this cash to acquire 7 dividend growth stocks. These stocks spanned 6 different sectors and provided a yield of 3.34%, knocking off the other two goals in this section.

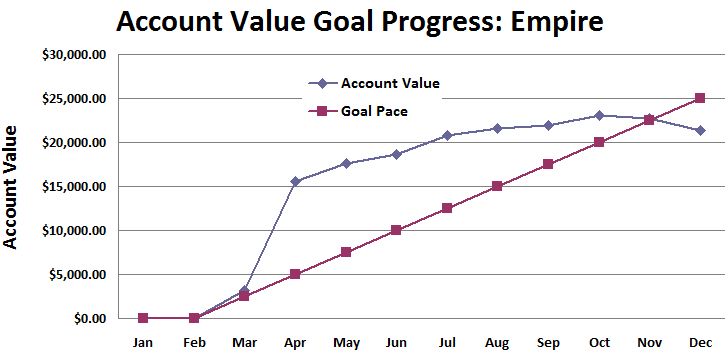

- Have an Empire portfolio value of at least $25,000.00 by the end of 2015. Failed

- This will be achieved through funding, dividend reinvestments and/or gains

Unfortunately I fell a little short of this goal. A couple of months ago I was saying that this goal was a sure thing. Then the market declined, taking my portfolio value with it.

I also purchased a new house so I wasn’t able to make my normal contributions the last couple of months. The initial shock of this real estate transaction has mostly passed and I expect to continue my regular monthly contributions soon.

Here is how my portfolio value looked throughout the year:

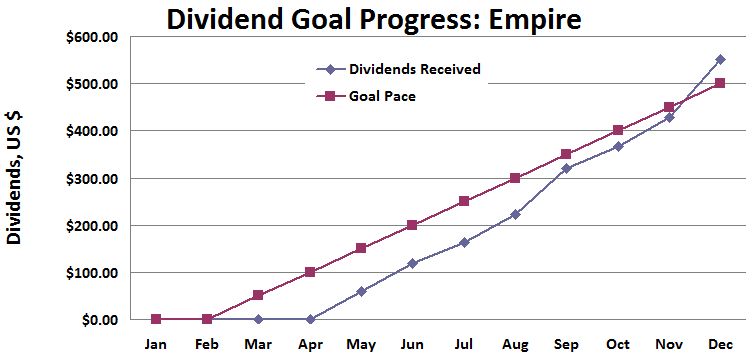

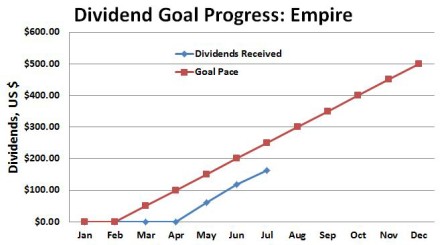

- Receive at least $500 in dividends in the Empire portfolio. Completed!

This was a close one that went down to the wire and I’m proud to say that I nailed it. I ended the year with $552.21 dividends received!

With the exception of stocks held in my Loyal3 account, all dividends were automatically reinvested. The stocks purchased through these DRIPs added $22.06 to my forward annual income and put my dividends back to work for me immediately.

Here is how my progress looked throughout the year:

- Start a blog to track and share my progress. Completed!

- Write 8 blog posts per month on average. Failed

- Provide monthly and quarterly progress updates. Completed!

I obviously started my blog – that was an easy one.

I also set a goal to write on average 8 blog posts per month. I set this goal to help keep me engaged in stock research, learning about dividend growth investing and providing value to my readers. Sadly I fell short on this goal. I wrote a total of 64 articles in nine months which puts me at an average of 7.1 per month.

I was way ahead of pace up until a couple of months ago when life got in the way. I will include a similar goal next year and make it a priority.

My last goal in the blog section was to provide monthly and quarterly progress updates. This was completed successfully and you can find links to all of these updates on my historical data page.

- 2015 Dividend Retirement portfolio goals:

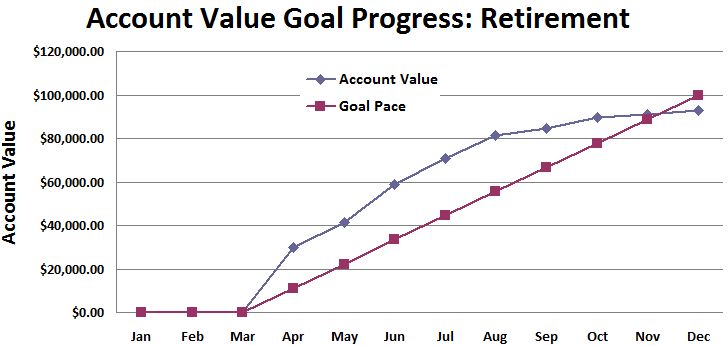

- Have a portfolio value of at least $100,000.00 by the end of 2015. Sort of Completed!

- Diversify across all sectors (Failed) with at least 30 different companies (Completed!)

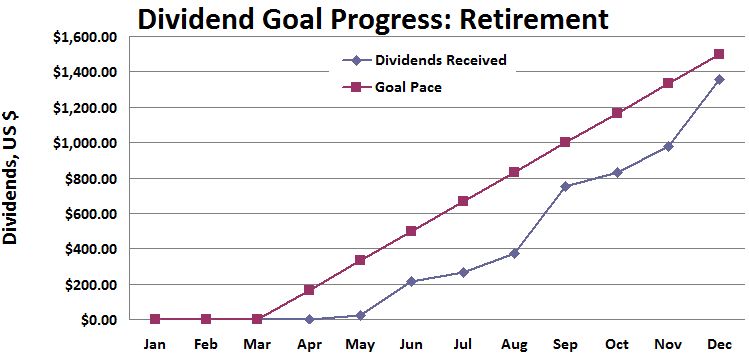

- Receive at least $1,500.00 in dividends. Failed

I made some rookie mistakes when putting together my Retirement portfolio goals.

The second bullet was my first blunder. Striving to own companies in all sectors and setting a number of different stocks to own is silly in my opinion. I quickly decided to focus on value and solid companies instead of diversity. This led me to be overweight in a few sectors but I have decades to balance things out.

My dividend goal was also an error. Since I was selling mutual funds in my 401k to fund this portfolio I basically had $100,000 at my disposal from the start. A 3% yield on that money would give me $3k in dividends, so I conservatively set a goal of $1500.

This, of course, was working under the assumption that I would sell all of my mutual funds and spend it all on stocks immediately. This would have been foolish. I ended up being very patient and selective with my stock purchases and to this date I STILL have a large amount of cash in this account. I haven’t even sold all of the mutual funds that I marked for conversion!

That said, let’s move on to my progress against these goals. I wrote “Sort of Completed” for the $100k portfolio value because although I’m only at $92k, the mutual funds I have yet to sell will easily cover the remaining $8k.

Although I failed to diversify across all sectors, I did manage to acquire stock from 30 different companies. But like I said above, this goal is basically meaningless to me.

Finally, I came much closer to the $1500 dividend goal than I thought I would. I ended up with a respectable $1359.65. If I wasn’t completely absent the last couple of months I might have actually hit this goal.

2016 Goals

Now it’s time to set my goals for the upcoming year.

Empire Portfolio Goals:

- Contribute at least $10,000.00 to the portfolio

- At least $1,000.00 will come from other investing activities (options, swing trading or day trading)

- Earn $1,000.00 in dividend income

- Sell options to earn extra income (calls & puts) and to acquire stock at attractive prices (puts)

Since I’m still getting used to the expenses associated with my new home and the possibility of growing my family this year I’m setting a low bar for contributions. I’m hopeful that I can contribute more than $10k, especially if my other investing activities go well.

I’m confident that I can break the $1k mark for dividends in 2016. My forward annual income is currently $807.84. $10,000 worth of investments spread out over the year should add around $120 more. The remaining $70 will hopefully come from DRIPs, dividend increases and/or more contributions.

Finally, I’m getting to the point where I can bring my beloved options back into my life and into my Empire portfolio. These will be conservative plays and obviously only on stocks that I am willing to carry 100 shares of. I will simply sell calls on existing positions that I believe are overvalued and I will sell puts on stocks that I wish to own at the strike price.

Retirement Portfolio Goals:

- Contribute at least $25,000.00 to the portfolio

- Earn $3,000.00 in dividend income

Our 401k contribution rates are pretty much set and it should amount to about $20,000.00. My wife and I contribute 5% each so we can take full advantage of our company match, which is a core 5% + up to a 5% match. So by contributing 5% of our own money we actually get 15%. The additional $5k to meet this goal will come from the sale of mutual funds.

As for the dividends, my forward annual income is about $2570 and $25k worth of investments over the course of the year should provide another $300. I’m expecting dividend increases and portfolio rebalancing to account for the remainder.

Other Goals:

- Write a total of 75 blog posts in 2016

- Create a day trading website to track my other investing activities. Completed!

- Earn extra income

- Earn at least $250 in ad revenue and writing from my two websites

- Earn at least $3,000 from day trading and swing trading

- Earn at least $500 from selling unwanted & unneeded items around the house

As I mentioned above, consistently writing blog posts is important to me. It keeps me focused, it keeps me organized and it hopefully provides some value to my readers and the DGI community. I set my goal to 75 for the year (or ~6 per month). This is slightly lower than last year’s goal and that is because I’ll be writing articles for two blogs; Dividend Empire & Day Trading Trek.

These two blogs will complement each other since each type of investing activity is beneficial to the other. Day trading and swing trading will help fund my dividend portfolios, and having fully funded dividend portfolios means financial independence (the main goal of Day Trading Trek).

Any profits from day trading will be split between the Empire portfolio (which will still remain untouched & off-limits to me), other dividend portfolios that I will set up (IRA, others), paying down debt and growing my day trading account.

Day Trading Trek is already up and running so I’ve already completed one of my 2016 goals! If you are interested in day trading please check out the new site and let me know what you think.

My last goal is to earn some extra income from three different sources. One of them is obvious and I’ve already discussed it above – day trading and swing trading. I believe $3,000 is doable, especially once my day trading account is fully funded (eta June 2016).

I’ve also set a goal to earn $250 from my websites. This isn’t much but it will at least cover the costs of running the sites. I made about $125 in 2015 so I think this is feasible.

Finally, I want to sell $500 worth of junk. I just moved about 50 boxes of stuff into my attic and half-way through the job I realized how silly it was. I will probably never see these items again so why am I keeping them?!? I’m sure I can easily get $500 this year through selling items on eBay, Amazon and Craigslist. All proceeds will go to the Empire portfolio.

So there you have it! 2015 was a wonderful year and I’m looking forward to my first full year as a dividend growth investor. I wish everyone a happy new year and I hope we all have a great 2016!

DE,

Nice goals. You did a nice job though in 2015 converting to dividend income stocks. Obviously, KMI didn’t help the cause and 2016 has started off on the downslope. Obviously – the downslope is great for us investors – a lot of keen stocks out there to keep your eye on – ADM, TGT, JNJ to name a few.

Congrats on the year and looking forward to seeing your 2016 goals come to completion! Good luck sir.

-Lanny

Thanks Lanny! I’m really looking forward to doing some shopping soon at these discounted prices. Best of luck to you as well!

Ken

На этом сайте https://kinokabra.ru/ вы можете бесплатно и без необходимости регистрации ознакомиться с релизными датами кинофильмов в новом киногоду. Следите за новинками и не забудьте поставить этот ресурс на заметку для мгновенного доступа к актуальным данным о кино. Узнайте первыми значимые события кинематографического мира, пройдитесь по новым проектам от талантливых режиссеров, насладитесь экшен-фильмами для ценителей динамичных сцен. Откройте для себя драматические фильмы, которые представят в начале ближайшего будущего. Встречайте с улыбкой с новыми комедиями. Погрузитесь в мир фантастики с самыми свежими фантастическими кинокартинами. Почувствуйте ужас с новыми фильмами ужасов. Влюбитесь в истории любви с романтичными фильмами на горизонте. Мечты детей станут реальностью с анимацией для маленьких и больших. Познакомьтесь о жизни известных персон с биографическими картинами. Загадочные фэнтезийные вселенные приглашают вас отправиться в путешествие. Актерские новинки знаменитых артистов ждут вас на экранах. Развлекайте детей и семью с фильмами для всей семьи. Отправляйтесь в увлекательные путешествия с фильмами о захватывающих путешествиях. Романтические истории ждут вас в картинах о чувствах и отношениях. Проведите время с документальными картинами с документальными работами. Не пропустите график выхода фильмов – узнайте, что смотреть в кино. Чтение и экран – книжные адаптации. Фэнтези и магия с элементами фэнтези ждут вас в новых фильмах. Супергеройские фильмы продолжаются в 2023 году. Загадки и тайны ожидают вас в фильмах с загадочным сюжетом. Путешествие в историю с фильмами о войне и истории. Путешествия по природе в фокусе с фильмами о природе и путешествиях. Из мира видеоигр к большому экрану с кино по видеоиграм. Современные технологии и научная фантастика на большом экране. Документальные ленты о животных и природе. Фильмы о музыке и музыкантах. Время для всей семьи на горизонте. Исследование космоса с фильмами о космосе и научной фантастике. Спортивные подвиги на экранах с новыми фильмами о спорте. Комбинированные жанры и комедийные драмы в кино. Искусство на экране. Загадки и мистика с кино о тайнах. Миры приключений в анимационных картинах.

___________________________________________________

Не забудьте добавить наш сайт в закладки:

На интернет-портале https://anekdotitut.ru/ вы окунетесь в мир безмерного юмора и смеха. Анекдоты – это не просто краткие истории, а фонтан веселья, какой способен поднять настроение в разной ситуации.

Шутки бывают разнообразные: забавные, добрые, остросоциальные и даже нелепые. Они могут рассказывать о обыденных ситуациях, персонажах известных мультсериалов или государственных деятелей, но всегда целью остается вызвать улыбку у публики.

На anekdotitut.ru собрана колоссальная коллекция анекдотов на самые различные тематики. Вы найдете здесь юмор о питомцах, семейных отношениях, рабочей деятельности, политической сфере и многие иные. Множество секций и рубрик помогут вам быстро найти анекдот по вашему вкусу.

Безотносительно вашего психологического состояния, юмор с anekdotitut.ru помогут вам расслабиться и забыть о повседневных заботах. Этот портал станет вашим постоянным компаньоном в положительных эмоций и радостных моментов.

___________________________________________________

Не забудьте добавить наш сайт https://anekdotitut.ru/ в закладки!

На веб-ресурсе https://amurplanet.ru/, посвященном всему, что интересно женщинам, вы сможете обнаружить большому числу захватывающих публикаций. Мы предлагаем уникальные советы в разносторонних аспектах, таких как здоровье и множество других областей.

Узнайте все секреты женской красоты и здоровья, следите за последними трендами в сфере моды и стиля. Мы публикуем статьи о психологии и межличностных отношениях, вопросах семейной жизни, карьере, саморазвитии. Вы также обнаружите практические советы по кулинарии, рецепты блюд, секреты воспитания детей и многое другое.

Наши материалы помогут сформировать атмосферное пространство, получить информацию о садоводстве и огородничестве, научиться заботиться о своем внешнем виде, сохранять свой здоровьем и фитнесом. Мы также предоставляем информацию о здоровом образе жизни, эффективном финансовом планировании и много других аспектах.

Присоединяйтесь к нашей аудитории для женщин на AmurPlanet.ru – и смотрите полезную информацию каждый день. Не упустите подписаться на наши новости, чтобы быть в курсе всех событий. Посетите наш сайт и получите доступ к миру женской тематики во полном объеме!

Не забудьте добавить сайт https://amurplanet.ru/ в закладки!

На портале https://antipushkin.ru/, посвященном мудрости, вы окунетесь в мир мудрых фраз великих философских гуру.

У нас посетителей ждет большой ассортимент цитат и афоризмов о смысле жизни и многих других темах.

Узнайте в глубокие мысли известных личностей и получите ценные уроки всегда и везде. Воплощайте цитаты и афоризмы для духовного совершенствования и продвижения вперед.

Присоединяйтесь к нашему сообществу и проникнитесь философией прямо сейчас на нашем портале. Исследуйте ценными уроками, которые позволит вам обогатиться antipushkin.ru.

Здесь собраны тысячи цитат и афоризмов, которые подарят вам мудрость в разных областях сознания. На сайте есть цитаты о смысле жизни, успехе и мотивации, гармонии и духовном развитии.

Сайт antipushkin.ru – это ваш проводник в мир мудрых мыслей. Мы предоставляем наиболее важные цитаты великих личностей, которые подарят вам мудрость в вашем духовном росте.

Подписывайтесь на наши обновления и будьте в курсе всех новых цитат. Наш портал с удовольствием предоставит вам дозу мудрости каждый день.

Сайт https://fotonons.ru/ показывает обширный спектр подходов в дизайне и декорировании интерьеров через фотографии. Вот некоторые ключевые моменты:

Вдохновение для Интерьера:

Демонстрация практических советов для преобразования жилых пространств.

Акцент на различные стили, включая прованс.

Разнообразие Контента:

Декорация балконов, гостинных, спален и других пространств.

Создание богатого резервуара идей для преобразования дома или рабочего пространства.

Практическое Применение:

Рекомендации по интеграции этих стилей в реальных условиях.

Мотивирующие примеры, показывающие возможности изменения пространства.

Этот текст увеличивает детализацию описания сайта, добавляет структуру в виде списков и перечислений, и размножен с использованием синонимов для увеличения вариативности.

___________________________________________________

Не забудьте добавить наш сайт в закладки: https://fotonons.ru/

Мейзу Клуб (https://mymeizuclub.ru/) – это обширный ресурс, посвященный всех аспектах продуктов Meizu. На сайте представлены различные категории, охватывающие смартфоны, наушники, фитнес-браслеты и множество умной техники. Пользователи могут разыскать подробные руководства и советы по использованию устройств Meizu, такие как обновление системы, повышение производительности, установку сервисов Google Play и множество других возможностей. Сайт также обеспечивает помощью в решении проблем, относящихся к устройствам Meizu, и предоставляет поддержку пользователей.

На mymeizuclub.ru вы найдете подробные отчеты о новейших моделях смартфонов Meizu. Эти статьи дадут вам полное представление возможностей и особенностей каждой модели.

Сайт также предлагает форумы пользователей, где вы можете поделиться своим опытом и задать вопросы о устройствах Meizu. Это отличная площадка для взаимодействия с единомышленниками.

Раздел часто задаваемых вопросов на mymeizuclub.ru является незаменимым источником информации для нахождения ответов на распространенные вопросы, связанные с продуктами Meizu.

Регулярно обновляемые новости и сообщения о новинках от Meizu обеспечат вас последней информацией о инновациях компании и новых продуктах.

Кроме того, раздел советов и трюков на сайте поможет вам максимально использовать ваших устройств Meizu, предлагая полезные инструкции по настройке их работы.

Не забудьте добавить наш сайт в закладки: https://mymeizuclub.ru/

Заслушаем.ру – это веб-сайт, предлагающий богатую коллекцию текстов песен. Сайт представляет песни множества стилей и языков, предоставляя доступ к разнообразному музыкальному контенту. Это полезный инструмент для музыкальных энтузиастов, стремящихся узнать слова своих излюбленных композиций. Для ознакомления с сайтом, его структурой и функционалом, вы можете посетить его, перейдя по ссылке: https://zaslushaem.ru/.

Сайт “zaslushaem.ru” хорошо структурирован и прост в навигации. Он предлагает поиск, для быстро искать тексты желаемых песен. Также на сайте имеется функция сортировки по артистам и названиям, что создает навигацию по сайту еще более удобной и понятной.

Дополнительная особенность сайта – это разделы с новинками и популярными песнями, которые пополняются регулярно. Это дает возможность пользователям следить за самых новых и трендовых музыкальных трендов. Также на сайте регулярно

можно найти интересные факты о песнях и их исполнителях, дополняя музыкальный опыт пользователей.

“Zaslushaem.ru” – это не только сайт для нахождения текстов песен, это место, где любители музыки могут общаться и общаться о музыке. Функциональность сайта непрерывно улучшается, включая нововведения для комфорта пользователей.

Откройте для себя Музыкальный Мир с https://zaslushaem.ru/: Твой Гид для Текстов Песен.

Сайт https://privlec-obras.ru/ – является исключительным онлайн-пространством, затрагивающим различные стороны женской красоты и ухода за собой. На этом сайте женщины найдут полезные сведения и экспертные советы о макияже.

Вы сможете ознакомиться с последними трендами в мире макияжа, получить советы по выбору косметики и научиться создавать уникальные образы для повседневной жизни.

На сайте вы найдете информацию о модных дизайнах ногтей, советы по уходу за ними и мастер-классы по созданию уникальных маникюрных образов, выразительно подчеркивающих вашу индивидуальность.

Вы сможете получить рекомендациями по выбору косметических средств, узнать секреты поддержания здоровой и сияющей кожи, а также ухоженных волос.

На нашем сайте вы найдете советы по созданию стильных образов, выбору аксессуаров и многое другое, что поможет вам быть на высоте.

Сайт https://privlec-obras.ru/ является верным источником информации и вдохновения, помогая вас оставаться красивой как изнутри, так и снаружи.

В Москве и ее окрестностях существует большое количество жилых комплексов, каждый из которых обладает уникальными особенностями и предложениями. На нашем сайте https://zhiloy-komplex.ru/ вы найдете актуальную информацию о самых привлекательных и комфортабельных жилых комплексах, объединяющих в себе новейший дизайн, превосходное качество строительства и удобное расположение.

Выбор жилья – это важное решение

Мы помогаем нашим посетителям сделать информированный выбор, предоставляя полную и актуальную информацию о каждом жилом комплексе. Наши обзоры включают детальное описание инфраструктуры района, наличие учебных и медицинских заведений, наличие зон отдыха и многое другое. Независимо от того, нужна ли квартира для молодой семьи или просторный пентхаус – у нас есть варианты на каждый вкус и бюджет.

Инновационные решения для удобной жизни

Столичный регион непрерывно развивается, и мы внимательно следим за всеми новинками в сфере жилищного строительства.

Не забудьте добавить наш сайт в закладки: https://zhiloy-komplex.ru//

Добро пожаловать в фантастический мир моих разнообразных мыслей и внутренних открытий! В этой замечательной рубрике https://amurplanet.ru/category/interesy/ я делюсь статьями, которые побудили меня к глубоким размышлениям и затронули мои интересы. Здесь каждая статья — это миниатюрное путешествие в мир мудрости, страсти и непрерывного стремления к пониманию окружающего нас мира.

Вас приветствуют разнообразные темы — от удивительных научных открытий и последних достижений в технике до творчества самопознания и вдохновляющих историй о жизни. Это прекрасное пространство, где интеллект встречается с эмоциями, а мысли находят свое отражение в словах.

Читайте мои статьи и погружайтесь глубже в обсуждение вопросов, которые волнуют меня. Здесь нет места для обыденных повествований — вы найдете лишь тщательно отобранный контент, способный расширить ваш взгляд и привнести в вас свежие идеи.

Приглашаю вас отправиться в путь по разделам этой уникальной рубрики и открыть для себя что-то уникальное. Готовьтесь к потрясающим взглядам на скрытые вопросы, и к новым горизонтам знаний. Позвольте этим словам стать колесницей к расширению вашего познавательного мира.

Не забудьте добавить наш сайт в закладки: https://amurplanet.ru/category/interesy/

Добро пожаловать в захватывающий мир моих разнообразных мыслей и личных открытий! В этой уникальной рубрике https://anekdotitut.ru/category/uvlecheniya/ я делюсь статьями, которые затрагивают интересы. Здесь каждая статья — это компактное путешествие в мир страсти.

Читайте мои статьи и погружайтесь в обсуждение вопросов, которые волнуют меня. Здесь нет места для банальных рассказов — только тщательно подобранный материал, способный расширить ваш кругозор и вызвать новые идеи.

Приглашаю вас отправиться по страницам этой рубрики и познакомиться с чем-то уникальным. Готовьтесь к захватывающим взглядам на вопросы, которые оставались в тени. Позвольте этим словам стать путеводным знаком к расширению вашего интеллектуального горизонта.

Не забудьте добавить наш сайт в закладки: https://anekdotitut.ru/category/uvlecheniya/

Страница https://telegra.ph/Gde-najti-recepty-dlya-multivarki-12-24 посвящена поиску разнообразных рецептов для мультиварки, практичного кухонного устройства, способствующего приготовлению еды. Автор предлагает несколько интересных источников для поиска рецептов: эксклюзивные кулинарные сайты и блоги, кулинарные книги и журналы, активные социальные сети и форумы, а также официальные приложения производителей мультиварок. Эти ресурсы предоставляют множество рецептов, начиная с повседневных блюд и заканчивая праздничными вариантов, а также полезные советы по использованию мультиварки. Страница подчеркивает, что использование мультиварки открывает разнообразные возможности для кулинарных экспериментов.

Детальную информацию можно получить на сайте https://telegra.ph/Gde-najti-recepty-dlya-multivarki-12-24.

Эта увлекательная страница блога https://akvarium12345.blogspot.com/2024/01/blog-post.html погружает нас с прекрасным миром аквариумов. В ней представлены радости хобби аквариумистики, с акцентом на его красоту. Также статья дает практические советы новичкам аквариумистов.

В статье также освещаются нюансы создания идеального аквариумного ландшафта. Автор делится экспертными советами по обустройству аквариума, облегчая процесс ухода за аквариумом.

Не забудьте добавить страницу в закладки: https://akvarium12345.blogspot.com/2024/01/blog-post.html/

На сайте https://rejtingtop-10.blogspot.com/ любители рейтингов откроют для себя широкий спектр обзоров и рекомендаций, которая постоянно обновляется для предоставления наиболее свежей информации. Этот ресурс идеален для тех, кто ищет объективные сведения и независимые рейтинги, чтобы сделать обдуманный выбор при покупке товаров. Особенностью сайта является его доступность, что делает его популярным среди разнообразных пользователей.

На rejtingtop-10.blogspot.com также представлены рейтинги не только товаров и услуг, но и культурных продуктов, таких как фильмы и песни. Эти рейтинги помогают пользователям ориентироваться в мире развлечений, предоставляя подробные анализы популярных медиапродуктов. Такое разнообразие контента делает сайт ценным ресурсом для любителей кино и музыки.

Для получения более подробной информации посетите https://rejtingtop-10.blogspot.com/.

Наши предпочтительные цветы – это не только декорация наших домашних интерьеров и садовых уголков, но и настоящий источник вдохновения. На странице блога https://vse-o-krasivyh-cvetah1.blogspot.com/ мы хотим поделиться с вами чудесным миром флоры и поведать о их удивительных свойствах и символике.

Цветы, как разноцветные полотна природы, могут выражать эмоции и чувства лучше, чем слова. Они способны пробудить радость, умиротворение или восхищение. Мы приглашаем вас погрузиться в мир цветов и осознать, какие эмоции они могут активировать у вас.

Кроме того, цветы имеют многовековую и богатую символику. От античных мифов до сегодняшних праздничных дней, они представляют собой ключевой элемент в нашей культуре и обрядовой практике. Мы поделимся вам о значении разных видов цветов и о том, какие цветы подходят для различных праздников и церемоний.

И, наконец, мы поделимся с вами советами по заботе о цветах, чтобы они всегда радовали вас своей красотой и свежестью. На странице https://vse-o-krasivyh-cvetah1.blogspot.com/ вы найдете множество полезных статей и рекомендаций, которые будут полезны вам сделать ваш сад и дом ярче и красивее благодаря цветам.

Ознакомьтесь с нашу страницу https://psychotestinsights.blogspot.com/2023/12/blog-post.html, чтобы познакомиться с миром психологических тестов и их значением в нашей повседневной жизни. В нашем динамичном мире, где стресс и ускоренный ритм существования являются обыденностью, понимание себя через психологические тесты может быть очень полезным, но и важным.

Наш блог дает новый угол зрения на все психологические тесты, их историю и применяемость в различных сферах. Мы разбираем, как результаты этих тестов могут способствовать вам в развитии личности, карьерном росте и улучшении межличностных отношений. Каждый тест – это метод самопознания и своих скрытых потенциалов.

В нашем блоге вы https://psychotestinsights.blogspot.com/2023/12/blog-post.html найдете советы о том, как корректно разгадывать данные психотестов и как воспользоваться ими для оптимизации повседневной жизни.

На нашем сайте https://citaty12345.blogspot.com/ вы найдете мотивирующую коллекцию цитат, которые имеют потенциал оказать глубокое влияние на вашу мышление. Цитаты от исторических личностей собраны здесь, чтобы принести вам пищу для размышлений для саморазвития.

Наш блог создан не только для любителей литературы и философии, но и для всех, кто желает найти новые идеи в словах. Здесь вы найдете цитаты на множество темы: от любви и дружбы до личностного роста. Каждая цитата – это мощное послание, которое может изменить ваш жизненный путь.

Мы тщательно отбираем цитаты, чтобы они были релевантными. Наши публикации позволяют вам погрузиться в мир глубоких мыслей, предлагая новые возможности. Мы полагаем, что умело выбранные слова являются источником новых идей.

Подписывайтесь нашего блога https://citaty12345.blogspot.com/ и находите для себя новые цитаты ежедневно. Независимо от того, стремитесь ли вы радость или просто хотите насладиться красотой слов, наш блог представит вам всё то, что вам необходимо. Позвольте этим цитатам присутствовать в вашего ежедневного вдохновения.

Блог https://citatystatusy.blogspot.com/ является ресурсом, ориентированным на мотивирующим цитатам и статусам. На сайте можно найти цитаты, целью которых является обогащение жизненного опыта через мудрые слова. Этот ресурс подчеркивает важность позитивного восприятия жизни, помогая найти счастье в мелочах.

Не забудьте страницу на блог в закладки: https://citatystatusy.blogspot.com/

Блог https://akpp-korobka.blogspot.com/ посвящен ключевым аспектам обслуживания и ремонта автоматических коробок передач (АКПП) в автомобилях. Он подчеркивает значимость АКПП в обеспечении плавной передачи мощности между двигателем и колесами, что является ключевым в эффективности автомобиля. Ресурс обсуждает важность своевременного обнаружения проблем АКПП для определения проблем, способствующего экономии время и деньги. Рассматриваются основные аспекты технического обслуживания АКПП, с упором на замену масла, поиск утечек и замену фильтров, для поддержания высокой эффективности трансмиссионной системы. Более подробную информацию найдете на блог по адресу https://akpp-korobka.blogspot.com/.

Романтические квесты и тесты для пар: Создайте новые страницы в вашей любви (https://testy-pro-lyubov-i-semyu.blogspot.com/2023/12/blog-post.html) – это забавные вопросники, созданные с целью обеспечивать веселье и развлечение. Они подносят участникам разные вопросы и задачи, которые часто относятся к увлекательным темам, личными предпочтениями или смешными сценариями. Основная главная цель таких тестов – предоставить участнику возможность получить удовольствие, проверить свои знания или открыть для себя что-то новое о себе или мире вокруг них. Развлекательные тесты широко распространены в онлайн-среде и социальных медиа, где они получили признание как популярные формы интерактивного развлечения и поделиться контентом.

Не забудьте добавить наш сайт в закладки: https://testy-pro-lyubov-i-semyu.blogspot.com/2023/12/blog-post.html

Интригующие тесты на психологические отклонения: Раскройте скрытые аспекты своего разума (https://teksty-otklonenij.blogspot.com/2023/12/blog-post.html) – это занимательные опросы, созданные для исследования глубин сознания. Они поднимают перед участниками разнообразные задачи, часто связанные с интересными темами психического здоровья. Основная цель таких тестов – дать пользователю перспективу увлекательно провести время, но и изучить свои личностные нюансы, расширить самосознание и потенциально найти неизвестные грани характера. Такие тесты завоевали признание как способ саморефлексии в сети и социальных сетях, где они предоставляют пользователям не только развлечение, но и метод самоанализа.

Не забудьте добавить в закладки ссылку на наш ресурс: https://teksty-otklonenij.blogspot.com/2023/12/blog-post.html

Увлекательные викторины для обучения и развития: Погрузитесь в мир знаний (https://obrazovatelnye-testy.blogspot.com/2023/12/blog-post.html) – это познавательные квизы, созданные с целью повышения образовательного уровня в увлекательной форме. Они подносят участникам разнообразные вопросы и задания, которые относятся к ключевым областям знаний. Основная задача этих опросов – обеспечить студентам возможность учиться в увлекательной форме, протестировать свои учебные достижения и обнаружить новые интересные факты. Эти тесты быстро завоевали признание в интернете и среди образовательных платформ, где они применяются как современные методы обучения и распространения образовательного контента.

Не забудьте добавить наш сайт в закладки для доступа к образовательным тестам: https://obrazovatelnye-testy.blogspot.com/2023/12/blog-post.html

Проникновенные тесты для женщин: Откройте женскую мудрость (https://zhenskie-testy.blogspot.com/2023/12/blog-post.html) – это занимательные опросы, предназначенные для глубокого самопознания. Они предлагают перед участницами множество заданий для самоанализа, часто связанные с женском здоровье. Основная миссия этих тестов – обеспечить возможность интересно провести время, а также способствовать разгадыванию личные нюансы. Эти тесты завоевали любовь среди женщин в интернете как метод самопознания.

Не забудьте добавить в закладки ссылку на наш ресурс: https://zhenskie-testy.blogspot.com/2023/12/blog-post.html

Советую прочитать эту статью про афоризмы и статусы https://frag-x.ru/aforizmy-i-sovremennye-vyzovy-primenenie-mudryx-slov-v-sovremennom-mire/.

Также не забудьте добавить сайт в закладки: https://frag-x.ru/aforizmy-i-sovremennye-vyzovy-primenenie-mudryx-slov-v-sovremennom-mire/

Советую прочитать эту статью про афоризмы и статусы http://www.03bur.ru/citaty-i-ekologiya-mudrye-slova-o-zabote-o-prirode/.

Также не забудьте добавить сайт в закладки: http://www.03bur.ru/citaty-i-ekologiya-mudrye-slova-o-zabote-o-prirode/

Советую прочитать эту статью про афоризмы и статусы http://www.cydak.ru/digest/2009.html.

Также не забудьте добавить сайт в закладки: http://www.cydak.ru/digest/2009.html

Советую прочитать эту статью про афоризмы и статусы http://izhora-news.ru/aforizmy-o-vremeni-uroki-cennosti-momenta/.

Также не забудьте добавить сайт в закладки: http://izhora-news.ru/aforizmy-o-vremeni-uroki-cennosti-momenta/

Советую прочитать эту статью про афоризмы и статусы https://humaninside.ru/poznavatelno/84196-aforizmy-o-tayne-zhizni-zagadki-mira-v-c.html

Также не забудьте добавить сайт в закладки: https://humaninside.ru/poznavatelno/84196-aforizmy-o-tayne-zhizni-zagadki-mira-v-c.html/

Советую прочитать эту статью про афоризмы и статусы https://4istorii.ru/avtorskie-rasskazy-i-istorii/129043-aforizmy-o-tekhnologicheskom-progress.html

Также не забудьте добавить сайт в закладки: https://4istorii.ru/avtorskie-rasskazy-i-istorii/129043-aforizmy-o-tekhnologicheskom-progress.html

Советую прочитать сайт про отопление https://a-so.ru/

Также не забудьте добавить сайт в закладки: https://a-so.ru/

Советую прочитать сайт про отопление https://artcet.ru/

Также не забудьте добавить сайт в закладки: https://artcet.ru/

Советую прочитать сайт про отопление https://artcet.ru/

Также не забудьте добавить сайт в закладки: https://artcet.ru/

Советую прочитать сайт про автостекла https://avtomaxi22.ru/

Также не забудьте добавить сайт в закладки: https://avtomaxi22.ru/

Советую прочитать сайт про цветы https://med-like.ru/

Также не забудьте добавить сайт в закладки: https://med-like.ru/

Советую прочитать сайт про металлоизделия https://metal82.ru/

Также не забудьте добавить сайт в закладки: https://metal82.ru/

Советую прочитать сайт города Лихославль https://admlihoslavl.ru/

Также не забудьте добавить сайт в закладки: https://admlihoslavl.ru/

Советуем посетить сайт о культуре https://elegos.ru/

Также не забудьте добавить сайт в закладки: https://elegos.ru/

Советуем посетить сайт о моде https://allkigurumi.ru/

Также не забудьте добавить сайт в закладки: https://allkigurumi.ru/

Советуем посетить сайт о моде https://40-ka.ru/

Также не забудьте добавить сайт в закладки: https://40-ka.ru/

Советуем посетить сайт о строительстве https://100sm.ru/

Также не забудьте добавить сайт в закладки: https://100sm.ru/

Советуем посетить сайт о строительстве https://club-columb.ru/

Также не забудьте добавить сайт в закладки: https://club-columb.ru/

Советуем посетить сайт о строительстве https://daibob.ru/

Также не забудьте добавить сайт в закладки: https://daibob.ru/

Советуем посетить сайт об авто https://gulliverauto.ru/

Также не забудьте добавить сайт в закладки: https://gulliverauto.ru/

Советуем посетить сайт об авто https://vektor-meh.ru/

Также не забудьте добавить сайт в закладки: https://vektor-meh.ru/

Советуем посетить сайт про ремонт крыши https://kryshi-remont.ru/

Также не забудьте добавить сайт в закладки: https://kryshi-remont.ru/

Советуем посетить сайт про стройку https://stroydvor89.ru/

Также не забудьте добавить сайт в закладки: https://stroydvor89.ru/

Советуем посетить сайт про кино https://kinokabra.ru/

Также не забудьте добавить сайт в закладки: https://kinokabra.ru/

Советуем посетить сайт про строительство https://daibob.ru/

Также не забудьте добавить сайт в закладки: https://daibob.ru/

Советуем посетить сайт про дрова https://drova-smolensk.ru/

Также не забудьте добавить сайт в закладки: https://drova-smolensk.ru/

Советуем посетить сайт про прицепы https://arenda-legkovyh-pricepov.ru/

Также не забудьте добавить сайт в закладки: https://arenda-legkovyh-pricepov.ru/

Советуем посетить сайт про прицепы https://amurplanet.ru/

Также не забудьте добавить сайт в закладки: https://amurplanet.ru/

Советуем посетить сайт с анекдотамиhttps://anekdotitut.ru/

Также не забудьте добавить сайт в закладки: https://anekdotitut.ru/

Советуем посетить сайт про автомасло https://usovanton.blogspot.com/

Также не забудьте добавить сайт в закладки: https://usovanton.blogspot.com/

Советуем посетить сайт про астрологию https://astrologiyanauka.blogspot.com/

Также не забудьте добавить сайт в закладки: https://astrologiyanauka.blogspot.com/

Советуем посетить сайт про диких животных https://telegra.ph/Tainstvennyj-mir-dikih-zhivotnyh-putevoditel-po-neizvedannym-tropam-prirody-12-23

Также не забудьте добавить сайт в закладки: https://telegra.ph/Tainstvennyj-mir-dikih-zhivotnyh-putevoditel-po-neizvedannym-tropam-prirody-12-23

Советуем посетить сайт про авто https://arenda-legkovyh-pricepov.ru/

Также не забудьте добавить сайт в закладки: https://arenda-legkovyh-pricepov.ru/

Советуем посетить сайт про грызунов https://telegra.ph/Mir-gryzunov-interesnye-fakty-i-vidy-melkih-zhivotnyh-na-yuge-Rossii-12-23

Также не забудьте добавить сайт в закладки: https://telegra.ph/Mir-gryzunov-interesnye-fakty-i-vidy-melkih-zhivotnyh-na-yuge-Rossii-12-23

Советуем посетить сайт про рептилий https://telegra.ph/Reptilii-Udivitelnyj-mir-cheshujchatyh-12-23

Также не забудьте добавить сайт в закладки: https://telegra.ph/Reptilii-Udivitelnyj-mir-cheshujchatyh-12-23

Советуем посетить сайт про домашних животных https://telegra.ph/Kak-uhazhivat-za-domashnimi-zhivotnymi-sovety-i-rekomendacii-12-23

Также не забудьте добавить сайт в закладки: https://telegra.ph/Kak-uhazhivat-za-domashnimi-zhivotnymi-sovety-i-rekomendacii-12-23

Советуем посетить сайт о кино https://kinokabra.ru/

Также не забудьте добавить сайт в закладки: https://kinokabra.ru/

Советуем посетить сайт о музыке https://zaslushaem.ru/

Также не забудьте добавить сайт в закладки: https://zaslushaem.ru/

Советуем посетить сайт конструктора кухни онлайн https://40-ka.ru/news/page/konstruktor-kuhni-online-besplatno

Также не забудьте добавить сайт в закладки: https://40-ka.ru/news/page/konstruktor-kuhni-online-besplatno

Советуем посетить сайт, чтобы прочитать о цветах в картинах https://daibob.ru/himiya-tsveta-kak-nauka-ozhivlyaet-iskusstvo/

Также не забудьте добавить сайт в закладки: https://daibob.ru/himiya-tsveta-kak-nauka-ozhivlyaet-iskusstvo/

Советуем посетить сайт https://allkigurumi.ru/products

Также не забудьте добавить сайт в закладки: https://allkigurumi.ru/products

Советуем посетить сайт https://allkigurumi.ru/products/kigurumu-stichs

Также не забудьте добавить сайт в закладки: https://allkigurumi.ru/products/kigurumu-stich

Советуем посетить сайт https://a-so.ru/

Также не забудьте добавить сайт в закладки: https://a-so.ru/

Советуем посетить сайт https://togliatti24.ru/svadebnye-tosty-chto-pozhelat-i-kakim-dolzhen-byt-tost/

Также не забудьте добавить сайт в закладки: https://togliatti24.ru/svadebnye-tosty-chto-pozhelat-i-kakim-dolzhen-byt-tost/

Советуем посетить сайт http://www.obzh.ru/mix/samye-smeshnye-sluchai-na-bolshix-press-konferenciyax-vladimira-putina.html

Также не забудьте добавить сайт в закладки: http://www.obzh.ru/mix/samye-smeshnye-sluchai-na-bolshix-press-konferenciyax-vladimira-putina.html

Советуем посетить сайт https://style.sq.com.ua/2021/10/25/kakim-dolzhen-byt-tost-na-svadbu-kak-vybrat/

Также не забудьте добавить сайт в закладки: https://style.sq.com.ua/2021/10/25/kakim-dolzhen-byt-tost-na-svadbu-kak-vybrat/

Советуем посетить сайт https://samaraonline24.ru/narodnyje-primjety-o-pogodje

Также не забудьте добавить сайт в закладки: https://samaraonline24.ru/narodnyje-primjety-o-pogodje

Советуем посетить сайт https://invest.kr.ua/igor-mamenko-i-ego-zhena.html

Также не забудьте добавить сайт в закладки: https://invest.kr.ua/igor-mamenko-i-ego-zhena.html

Советуем посетить сайт https://pfo.volga.news/594544/article/obrazy-russkogo-nemca-i-amerikanca-v-anekdotah.html

Также не забудьте добавить сайт в закладки: https://pfo.volga.news/594544/article/obrazy-russkogo-nemca-i-amerikanca-v-anekdotah.html

Советуем посетить сайт https://podveski-remont.ru/

Также не забудьте добавить сайт в закладки: https://podveski-remont.ru/

We recommend visiting the website https://etc.bdir.in/dialogue/movies/A

Also, don’t forget to add the site to your bookmarks: https://etc.bdir.in/dialogue/movies/A

Советуем посетить сайт https://mama.ru/forums/theme/kredity/page/22/

Также не забудьте добавить сайт в закладки: https://mama.ru/forums/theme/kredity/page/22/

Советуем посетить сайт https://pravchelny.ru/useful/?id=1266

Также не забудьте добавить сайт в закладки: https://pravchelny.ru/useful/?id=1266

Советуем посетить сайт https://amurplanet.ru/

Также не забудьте добавить сайт в закладки: https://amurplanet.ru/

Советуем посетить сайт http://yury-reshetnikov.elegos.ru

Также не забудьте добавить сайт в закладки: http://yury-reshetnikov.elegos.ru

Советуем посетить сайт http://oleg-pogudin.elegos.ru/

Также не забудьте добавить сайт в закладки: http://oleg-pogudin.elegos.ru/

Советуем посетить сайт https://krasilovdreams.borda.ru/?1-11-0-00000014-000-30-0-1266268332

Также не забудьте добавить сайт в закладки: https://krasilovdreams.borda.ru/?1-11-0-00000014-000-30-0-1266268332

Советуем посетить сайт http://rara-rara.ru/menu-texts/5_voennyh_pesen_v_neobychnom_ispolnenii

Также не забудьте добавить сайт в закладки: http://rara-rara.ru/menu-texts/5_voennyh_pesen_v_neobychnom_ispolnenii

Советуем посетить сайт https://anekdotitut.ru/kak-promokody-pomogayut-sekonomit-na-onlajn-pokupkah/

Также не забудьте добавить сайт в закладки: https://anekdotitut.ru/kak-promokody-pomogayut-sekonomit-na-onlajn-pokupkah/

Советуем посетить сайт https://antipushkin.ru/preimushhestva-ispolzovaniya-promokodov-pri-onlajn-pokupkah/

Также не забудьте добавить сайт в закладки: https://antipushkin.ru/preimushhestva-ispolzovaniya-promokodov-pri-onlajn-pokupkah/

Советуем посетить сайт https://fotonons.ru/preimushhestva-ispolzovaniya-promokodov-pri-onlajn-pokupkah/

Также не забудьте добавить сайт в закладки: https://fotonons.ru/preimushhestva-ispolzovaniya-promokodov-pri-onlajn-pokupkah/

Советуем посетить сайт https://kinokabra.ru/promokody-glavnye-roli-v-mire-mody-i-kino/

Также не забудьте добавить сайт в закладки: https://kinokabra.ru/promokody-glavnye-roli-v-mire-mody-i-kino/

Советуем посетить сайт https://mymeizuclub.ru/polezno/ekonomiya-v-seti-kak-promokody-delayut-vashi-onlajn-pokupki-bolee-vygodnymi

Также не забудьте добавить сайт в закладки: https://mymeizuclub.ru/polezno/ekonomiya-v-seti-kak-promokody-delayut-vashi-onlajn-pokupki-bolee-vygodnymi

Советуем посетить сайт https://anekdotitut.ru/srochnyj-vykup-avto-v-saratove-kak-eto-proishodit-i-kakie-preimushhestva/

Также не забудьте добавить сайт в закладки: https://anekdotitut.ru/srochnyj-vykup-avto-v-saratove-kak-eto-proishodit-i-kakie-preimushhestva/

Советуем посетить сайт https://anekdotitut.ru/pochemu-vazhna-konsultatsiya-surdologa-dlya-detej-s-problemami-sluha/

Также не забудьте добавить сайт в закладки: https://anekdotitut.ru/pochemu-vazhna-konsultatsiya-surdologa-dlya-detej-s-problemami-sluha/

Советуем посетить сайт https://zaslushaem.ru/ekonomiya-v-seti-preimushhestva-promokodov-pri-onlajn-pokupkah

Также не забудьте добавить сайт в закладки: https://zaslushaem.ru/ekonomiya-v-seti-preimushhestva-promokodov-pri-onlajn-pokupkah

Советуем посетить сайт https://zhiloy-komplex.ru/promokody-vash-nadezhnyj-sputnik-v-mire-onlajn-shopinga/

Также не забудьте добавить сайт в закладки: https://zhiloy-komplex.ru/promokody-vash-nadezhnyj-sputnik-v-mire-onlajn-shopinga/

Советуем посетить сайт https://admlihoslavl.ru/promokody-sekretnyj-instrument-ekonomii-v-mire-onlajn-shopinga/

Также не забудьте добавить сайт в закладки: https://admlihoslavl.ru/promokody-sekretnyj-instrument-ekonomii-v-mire-onlajn-shopinga/

Советуем посетить сайт https://elegos.ru/promokody-vash-put-k-ekonomii-i-udovolstviyu-v-mire-onlajn-shopinga/

Также не забудьте добавить сайт в закладки: https://elegos.ru/promokody-vash-put-k-ekonomii-i-udovolstviyu-v-mire-onlajn-shopinga/

Советуем посетить сайт https://avtomaxi22.ru/

Также не забудьте добавить сайт в закладки: https://avtomaxi22.ru/

Советуем посетить сайт https://med-like.ru/

Также не забудьте добавить сайт в закладки: https://med-like.ru/

Советуем посетить сайт https://admlihoslavl.ru/

Также не забудьте добавить сайт в закладки: https://admlihoslavl.ru/

Советуем посетить сайт https://elegos.ru/

Также не забудьте добавить сайт в закладки: https://elegos.ru/

Советуем посетить сайт https://100sm.ru/

Также не забудьте добавить сайт в закладки: https://100sm.ru/

Советуем посетить сайт https://club-columb.ru/

Также не забудьте добавить сайт в закладки: https://club-columb.ru/

Советуем посетить сайт https://softnewsportal.ru/

Также не забудьте добавить сайт в закладки: https://softnewsportal.ru/

Советуем посетить сайт https://gulliverauto.ru/

Также не забудьте добавить сайт в закладки: https://gulliverauto.ru/

Советуем посетить сайт https://doutuapse.ru/

Также не забудьте добавить сайт в закладки: https://doutuapse.ru/

Советуем посетить сайт https://russkiy-spaniel.ru/

Также не забудьте добавить сайт в закладки: https://russkiy-spaniel.ru/

Советуем посетить сайт https://stroydvor89.ru/

Также не забудьте добавить сайт в закладки: https://stroydvor89.ru/

Советуем посетить сайт https://magic-magnit.ru//

Также не забудьте добавить сайт в закладки: https://magic-magnit.ru/

We recommend visiting the website https://mywebsitegirl.com/.

Also, don’t forget to bookmark the site: https://mywebsitegirl.com/

We recommend visiting the website https://villa-sunsetlady.com/.

Also, don’t forget to bookmark the site: https://villa-sunsetlady.com/

We recommend visiting the website https://realskinbeauty.com/.

Also, don’t forget to bookmark the site: https://realskinbeauty.com/

We recommend visiting the website https://talksoffashion.com/.

Also, don’t forget to bookmark the site: https://talksoffashion.com/

We recommend visiting the website https://skinsoulbeauty.com/.

Also, don’t forget to bookmark the site: https://skinsoulbeauty.com/

We recommend visiting the website https://powerofquotes12.blogspot.com/2024/03/the-power-of-quotes-inspiration-for.html.

Also, don’t forget to bookmark the site: https://powerofquotes12.blogspot.com/2024/03/the-power-of-quotes-inspiration-for.html

We recommend visiting the website https://quotes-status1.blogspot.com/2024/03/the-power-of-quotes-inspiration-for.html.

Also, don’t forget to bookmark the site: https://quotes-status1.blogspot.com/2024/03/the-power-of-quotes-inspiration-for.html

We recommend visiting the website https://quotablemoments1.blogspot.com/2024/03/embracing-lifes-wisdom-how-quotes-can.html.

Also, don’t forget to bookmark the site: https://quotablemoments1.blogspot.com/2024/03/embracing-lifes-wisdom-how-quotes-can.html

We recommend visiting the website https://wisdominwords123.blogspot.com/2024/03/unlocking-lifes-treasures-timeless.html.

Also, don’t forget to bookmark the site: https://wisdominwords123.blogspot.com/2024/03/unlocking-lifes-treasures-timeless.html

We recommend visiting the website https://wisdominwords123.blogspot.com/2024/03/echoes-of-wisdom.html.

Also, don’t forget to bookmark the site: https://wisdominwords123.blogspot.com/2024/03/echoes-of-wisdom.html

We recommend visiting the website https://telegra.ph/The-Radiance-of-Positivity-Exploring-the-Power-of-Positive-Quotes-03-31.

Also, don’t forget to bookmark the site: https://telegra.ph/The-Radiance-of-Positivity-Exploring-the-Power-of-Positive-Quotes-03-31

We recommend visiting the website https://telegra.ph/The-Craft-of-Achievement-Finding-Inspiration-in-Work-Quotes-03-31.

Also, don’t forget to bookmark the site: https://telegra.ph/The-Craft-of-Achievement-Finding-Inspiration-in-Work-Quotes-03-31

We recommend visiting the website https://telegra.ph/The-Bonds-We-Cherish-Celebrating-Connections-Through-Friendship-Quotes-03-31.

Also, don’t forget to bookmark the site: https://telegra.ph/The-Bonds-We-Cherish-Celebrating-Connections-Through-Friendship-Quotes-03-31

We recommend visiting the website https://telegra.ph/The-Drive-Within-Unlocking-Potential-with-Motivational-Quotes-03-31.

Also, don’t forget to bookmark the site: https://telegra.ph/The-Drive-Within-Unlocking-Potential-with-Motivational-Quotes-03-31

Мы рекомендуем посетить веб-сайт https://telegra.ph/Luchshie-prikormki-dlya-lovli-shchuki-v-2024-godu-03-31.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Luchshie-prikormki-dlya-lovli-shchuki-v-2024-godu-03-31

Мы рекомендуем посетить веб-сайт https://telegra.ph/Luchshie-internet-magaziny-rybolovnyh-snastej-03-31.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Luchshie-internet-magaziny-rybolovnyh-snastej-03-31

Мы рекомендуем посетить веб-сайт https://telegra.ph/Uspeh-na-konce-udochki-kak-vybrat-i-ispolzovat-kachestvennoe-rybolovnoe-oborudovanie-03-31.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Uspeh-na-konce-udochki-kak-vybrat-i-ispolzovat-kachestvennoe-rybolovnoe-oborudovanie-03-31

Мы рекомендуем посетить веб-сайт https://telegra.ph/Instrumenty-dlya-udovolstviya-pochemu-kachestvennoe-rybolovnoe-oborudovanie—zalog-uspeshnoj-i-komfortnoj-rybalki-03-31.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Instrumenty-dlya-udovolstviya-pochemu-kachestvennoe-rybolovnoe-oborudovanie—zalog-uspeshnoj-i-komfortnoj-rybalki-03-31

Мы рекомендуем посетить веб-сайт https://telegra.ph/Sekrety-uspeshnogo-ulova-znachenie-pravilnogo-vybora-i-ispolzovaniya-oborudovaniya-pri-rybalke-03-31.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Sekrety-uspeshnogo-ulova-znachenie-pravilnogo-vybora-i-ispolzovaniya-oborudovaniya-pri-rybalke-03-31

Мы рекомендуем посетить веб-сайт https://telegra.ph/Na-rybalku-s-uverennostyu-kak-vybrat-kachestvennoe-oborudovanie-dlya-uspeshnoj-rybalki-03-31.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Na-rybalku-s-uverennostyu-kak-vybrat-kachestvennoe-oborudovanie-dlya-uspeshnoj-rybalki-03-31

Мы рекомендуем посетить веб-сайт https://telegra.ph/Rybachok-vsyo-neobhodimoe-dlya-rybolova-03-31.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Rybachok-vsyo-neobhodimoe-dlya-rybolova-03-31

Мы рекомендуем посетить веб-сайт https://telegra.ph/Osnovnye-principy-udachnoj-rybalki-03-31.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Osnovnye-principy-udachnoj-rybalki-03-31

Мы рекомендуем посетить веб-сайт https://telegra.ph/CHto-neobhodimo-vzyat-s-soboj-na-rybalku-03-31.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/CHto-neobhodimo-vzyat-s-soboj-na-rybalku-03-31

Мы рекомендуем посетить веб-сайт https://softnewsportal.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://softnewsportal.ru/

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-Vash-provodnik-v-mire-rybolovstva-04-09-2.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-Vash-provodnik-v-mire-rybolovstva-04-09-2

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-Vash-nadezhnyj-pomoshchnik-v-mire-rybolovstva-04-09.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-Vash-nadezhnyj-pomoshchnik-v-mire-rybolovstva-04-09

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-Vash-provodnik-v-mire-rybolovstva-04-09.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-Vash-provodnik-v-mire-rybolovstva-04-09

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-Vash-vernyj-sputnik-v-mire-rybnoj-lovli-04-09.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-Vash-vernyj-sputnik-v-mire-rybnoj-lovli-04-09

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-Vash-nadezhnyj-pomoshchnik-v-mire-rybolovstva-04-09-3.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-Vash-nadezhnyj-pomoshchnik-v-mire-rybolovstva-04-09-3

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-Vash-vernyj-sputnik-v-mire-rybnoj-lovli-04-09-2.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-Vash-vernyj-sputnik-v-mire-rybnoj-lovli-04-09-2

Мы рекомендуем посетить веб-сайт https://doutuapse.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://doutuapse.ru/

Мы рекомендуем посетить веб-сайт https://vektor-meh.ru//.

Кроме того, не забудьте добавить сайт в закладки: https://vektor-meh.ru/

Мы рекомендуем посетить веб-сайт https://russkiy-spaniel.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://russkiy-spaniel.ru/

Мы рекомендуем посетить веб-сайт https://stroydvor89.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://stroydvor89.ru/

Мы рекомендуем посетить веб-сайт https://magic-magnit.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://magic-magnit.ru/

Мы рекомендуем посетить веб-сайт https://kvest4x4.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://kvest4x4.ru/

Ищете идеальный подарок или хотите украсить свой торжество незабываемыми впечатлениями?

Советуем вам: Гелевые шары недорого Москва

Рекомендуем добавить сайт http://carstvo-sharov.ru в закладки.

Мы рекомендуем посетить веб-сайт https://90sad.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://90sad.ru/

Мы рекомендуем посетить веб-сайт https://kmc-ia.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://kmc-ia.ru/

Мы рекомендуем посетить веб-сайт https://thebachelor.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://thebachelor.ru/

Мы рекомендуем посетить веб-сайт https://kreativ-didaktika.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://kreativ-didaktika.ru/

Мы рекомендуем посетить веб-сайт https://cultureinthecity.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://cultureinthecity.ru/

Мы рекомендуем посетить веб-сайт http://vanillarp.ru/.

Кроме того, не забудьте добавить сайт в закладки: http://vanillarp.ru/

Мы рекомендуем посетить веб-сайт https://urkarl.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://urkarl.ru/

Мы рекомендуем посетить веб-сайт https://upsskirt.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://upsskirt.ru/

Мы рекомендуем посетить веб-сайт https://yarus-kkt.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://yarus-kkt.ru/

Мы рекомендуем посетить веб-сайт https://imgtube.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://imgtube.ru/

Мы рекомендуем посетить веб-сайт https://svetnadegda.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://svetnadegda.ru/

Мы рекомендуем посетить веб-сайт https://tione.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://tione.ru/

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-vash-vybor-dlya-uspeshnoj-rybalki-04-15.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-vash-vybor-dlya-uspeshnoj-rybalki-04-15

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-vash-put-k-uspeshnoj-rybalke-04-15.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-vash-put-k-uspeshnoj-rybalke-04-15

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-vash-partner-v-mire-rybnoj-lovli-04-15.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-vash-partner-v-mire-rybnoj-lovli-04-15

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-vash-nadezhnyj-partner-v-mire-rybalki-04-15-2.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-vash-nadezhnyj-partner-v-mire-rybalki-04-15-2

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-vash-vybor-dlya-uspeshnoj-rybalki-04-15-2.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-vash-vybor-dlya-uspeshnoj-rybalki-04-15-2

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-vash-put-k-udachnoj-rybalke-04-15.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-vash-put-k-udachnoj-rybalke-04-15

Мы рекомендуем посетить веб-сайт https://telegra.ph/O-magazine-Rybachok-04-15.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/O-magazine-Rybachok-04-15

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-vash-put-k-uspeshnoj-rybalke-04-15-2.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-vash-put-k-uspeshnoj-rybalke-04-15-2

Мы рекомендуем посетить веб-сайт https://telegra.ph/Internet-magazin-Rybachok-vash-nadezhnyj-partner-v-mire-rybnoj-lovli-04-15.

Кроме того, не забудьте добавить сайт в закладки: https://telegra.ph/Internet-magazin-Rybachok-vash-nadezhnyj-partner-v-mire-rybnoj-lovli-04-15

Мы рекомендуем посетить веб-сайт https://burger-kings.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://burger-kings.ru/

Мы рекомендуем посетить веб-сайт http://voenoboz.ru/.

Кроме того, не забудьте добавить сайт в закладки: http://voenoboz.ru/

Мы рекомендуем посетить веб-сайт https://remonttermexov.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://remonttermexov.ru/

Мы рекомендуем посетить веб-сайт https://lostfiilmtv.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://lostfiilmtv.ru/

Мы рекомендуем посетить веб-сайт https://my-caffe.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://my-caffe.ru/

Мы рекомендуем посетить веб-сайт https://adventime.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://adventime.ru/

Мы рекомендуем посетить веб-сайт для ознакомления с методами налоговой оптимизации ссылка.

Не пропустите возможность узнать больше о важности налогового аудита для вашего бизнеса, добавьте в закладки нашу страницу: ссылка

Мы рекомендуем посетить веб-сайт https://kaizen-tmz.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://kaizen-tmz.ru/

Мы рекомендуем посетить веб-сайт https://mehelper.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://mehelper.ru/

Мы рекомендуем посетить веб-сайт https://useit2.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://useit2.ru/

Мы рекомендуем посетить веб-сайт https://center-esm.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://center-esm.ru/

Мы рекомендуем посетить веб-сайт https://stalker-land.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://stalker-land.ru/

Мы рекомендуем посетить веб-сайт http://skatertsamobranka.ru/.

Кроме того, не забудьте добавить сайт в закладки: http://skatertsamobranka.ru/

Мы рекомендуем посетить веб-сайт https://kanunnikovao.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://kanunnikovao.ru/

Мы рекомендуем посетить веб-сайт https://church-bench.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://church-bench.ru/

Мы рекомендуем посетить веб-сайт https://novaplastica.ru/luchshie-sposoby-podderzhaniya-zdorovya-v-techenie-dnya/.

Кроме того, не забудьте добавить сайт в закладки: https://novaplastica.ru/luchshie-sposoby-podderzhaniya-zdorovya-v-techenie-dnya/

Мы рекомендуем посетить веб-сайт ссылка.

Мы рекомендуем посетить веб-сайт https://btc-fish.ru/kak-izbezhat-stressa-na-rabote/.

Кроме того, не забудьте добавить сайт в закладки: https://btc-fish.ru/kak-izbezhat-stressa-na-rabote/

Мы рекомендуем посетить веб-сайт https://lodtrk.org.ua/kak-pravilno-vybrat-udochku-sekrety-uspeshnoy-rybalki/.

Кроме того, не забудьте добавить сайт в закладки: https://lodtrk.org.ua/kak-pravilno-vybrat-udochku-sekrety-uspeshnoy-rybalki/

Мы рекомендуем посетить веб-сайт https://kobovec.org.ua/interesnoe/issledovanie-produktivnye-tovary-dlya-rybakov-kotorye-uluchshat-vash-opyt/.

Кроме того, не забудьте добавить сайт в закладки: https://kobovec.org.ua/interesnoe/issledovanie-produktivnye-tovary-dlya-rybakov-kotorye-uluchshat-vash-opyt/

Мы рекомендуем посетить веб-сайт https://car2steal.ru/magazin-ribachok/.

Кроме того, не забудьте добавить сайт в закладки: https://car2steal.ru/magazin-ribachok/

Мы рекомендуем посетить веб-сайт https://kartina.info/.

Кроме того, не забудьте добавить сайт в закладки: https://kartina.info/

Мы рекомендуем посетить веб-сайт ссылка.

Кроме того, не забудьте добавить сайт в закладки: ссылка

Мы рекомендуем посетить веб-сайт https://ecoenergy.org.ua/news/rybolovnye-snasti-polnoe-rukovodstvo-dlya-rybakov-vseh-urovney.html.

Кроме того, не забудьте добавить сайт в закладки: https://ecoenergy.org.ua/news/rybolovnye-snasti-polnoe-rukovodstvo-dlya-rybakov-vseh-urovney.html

Мы рекомендуем посетить веб-сайт https://nastroenie.com.ua/masterstvo-v-uhode-za-karpom-ekspertnye-sovety-i-prakticheskie-podskazki/.

Кроме того, не забудьте добавить сайт в закладки: https://nastroenie.com.ua/masterstvo-v-uhode-za-karpom-ekspertnye-sovety-i-prakticheskie-podskazki/

Мы рекомендуем посетить веб-сайт https://replyua.net.ua/ru/effektivnye-aksessuary-dlya-hraneniya-ulova-i-zhivtsa/.

Кроме того, не забудьте добавить сайт в закладки: https://replyua.net.ua/ru/effektivnye-aksessuary-dlya-hraneniya-ulova-i-zhivtsa/

Мы рекомендуем посетить веб-сайт https://automir.in.ua/newsm.php?id=23145.

Кроме того, не забудьте добавить сайт в закладки: https://automir.in.ua/newsm.php?id=23145

Мы рекомендуем посетить веб-сайт https://avto.dzerghinsk.org/publ/poleznaja_informacija/zagadka_podvodnogo_mira_iskusstvo_prikarmlivanija_ryby/1-1-0-1271.

Кроме того, не забудьте добавить сайт в закладки: https://avto.dzerghinsk.org/publ/poleznaja_informacija/zagadka_podvodnogo_mira_iskusstvo_prikarmlivanija_ryby/1-1-0-1271

Мы рекомендуем посетить веб-сайт https://business.dp.ua/inform16/654.htm.

Кроме того, не забудьте добавить сайт в закладки: https://business.dp.ua/inform16/654.htm

Мы рекомендуем посетить веб-сайт https://dneprnews.com.ua/other/2024/05/24/295732.html.

Кроме того, не забудьте добавить сайт в закладки: https://dneprnews.com.ua/other/2024/05/24/295732.html

Мы рекомендуем посетить веб-сайт https://topnews.kiev.ua/other/2024/05/24/160818.html.

Кроме того, не забудьте добавить сайт в закладки: https://topnews.kiev.ua/other/2024/05/24/160818.html

Мы рекомендуем посетить веб-сайт https://uanews.kharkiv.ua/other/2024/05/24/457958.html.

Кроме того, не забудьте добавить сайт в закладки: https://uanews.kharkiv.ua/other/2024/05/24/457958.html

Мы рекомендуем посетить веб-сайт https://city-ck.com/catalog/articles/2024-05/podsaki-i-bagri-neotemlemie-atributi-uspeshnoi-ribalki.html.

Кроме того, не забудьте добавить сайт в закладки: https://city-ck.com/catalog/articles/2024-05/podsaki-i-bagri-neotemlemie-atributi-uspeshnoi-ribalki.html

Мы рекомендуем посетить веб-сайт https://brands.kiev.ua/?p=7921.

Кроме того, не забудьте добавить сайт в закладки: https://brands.kiev.ua/?p=7921

Мы рекомендуем посетить веб-сайт https://kupimebel.info/instrumenty-dlya-rybalki-osnova-uspeshnogo-promysla/.

Кроме того, не забудьте добавить сайт в закладки: https://kupimebel.info/instrumenty-dlya-rybalki-osnova-uspeshnogo-promysla/

Мы рекомендуем посетить веб-сайт https://city.zp.ua/articles/recreation/400-polotenca-dlja-rybalki-nezamenimyi-aksessuar-v-mire-uvlekatelnogo-otdyha.html.

Кроме того, не забудьте добавить сайт в закладки: https://city.zp.ua/articles/recreation/400-polotenca-dlja-rybalki-nezamenimyi-aksessuar-v-mire-uvlekatelnogo-otdyha.html

Мы рекомендуем посетить веб-сайт http://archaeology.kiev.ua/aksessuaryi-dlya-zashhityi-i-transportirovki-ryibolovnogo-oborudovaniya/.

Кроме того, не забудьте добавить сайт в закладки: http://archaeology.kiev.ua/aksessuaryi-dlya-zashhityi-i-transportirovki-ryibolovnogo-oborudovaniya/

Мы рекомендуем посетить веб-сайт http://oweamuseum.odessa.ua/full/travel61/vybor-udilishcha-dlya-rybalki-iskusstvo-podbora-idealnogo-snaryazheniya.htm.

Кроме того, не забудьте добавить сайт в закладки: http://oweamuseum.odessa.ua/full/travel61/vybor-udilishcha-dlya-rybalki-iskusstvo-podbora-idealnogo-snaryazheniya.htm

Мы рекомендуем посетить веб-сайт http://history.odessa.ua/travel49/vse-chto-vy-dolzhny-znat-pered-pokupkoy-kotushki.htm.

Кроме того, не забудьте добавить сайт в закладки: http://history.odessa.ua/travel49/vse-chto-vy-dolzhny-znat-pered-pokupkoy-kotushki.htm

Мы рекомендуем посетить веб-сайт https://planetarebusov.com/masterim-idealnyj-ulov-rukovodstvo-po-montazham-rybolovnym.

Кроме того, не забудьте добавить сайт в закладки: https://planetarebusov.com/masterim-idealnyj-ulov-rukovodstvo-po-montazham-rybolovnym

Мы рекомендуем посетить веб-сайт https://sunsay.name/statti/rybolovnye-primanki-i-iskusstvo-ih-ispolzovaniya/.

Кроме того, не забудьте добавить сайт в закладки: https://sunsay.name/statti/rybolovnye-primanki-i-iskusstvo-ih-ispolzovaniya/

Мы рекомендуем посетить веб-сайт https://med-like.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://med-like.ru/

Мы рекомендуем посетить веб-сайт https://metal82.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://metal82.ru/

Мы рекомендуем посетить веб-сайт https://kryshi-remont.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://kryshi-remont.ru/

Мы рекомендуем посетить веб-сайт https://balkonnaya-dver.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://balkonnaya-dver.ru/

Мы рекомендуем посетить веб-сайт https://drova-smolensk.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://drova-smolensk.ru/

Мы рекомендуем посетить веб-сайт https://podveski-remont.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://podveski-remont.ru/

Мы рекомендуем посетить веб-сайт https://admlihoslavl.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://admlihoslavl.ru/

Мы рекомендуем посетить веб-сайт https://elegos.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://elegos.ru/

Мы рекомендуем посетить веб-сайт https://ancientcivs.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://ancientcivs.ru/

Мы рекомендуем посетить веб-сайт https://allkigurumi.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://allkigurumi.ru/

Мы рекомендуем посетить веб-сайт https://40-ka.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://40-ka.ru/

Мы рекомендуем посетить веб-сайт https://100sm.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://100sm.ru/

Мы рекомендуем посетить веб-сайт https://club-columb.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://club-columb.ru/

Мы рекомендуем посетить веб-сайт https://daibob.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://daibob.ru/

Мы рекомендуем посетить веб-сайт https://vektor-meh.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://vektor-meh.ru/

Мы рекомендуем посетить веб-сайт https://great-galaxy.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://great-galaxy.ru/

Мы рекомендуем посетить веб-сайт <a href="https://doutuapse.ru/.

Кроме того, не забудьте добавить сайт в закладки: https://doutuapse.ru/

Мы рекомендуем посетить веб-сайт

https://ninjateknik.com/konstnaren-vandaliserar-snapchat-och-jeff-koons-ar-skulptur/

Кроме того, не забудьте добавить сайт в закладки:

http://icnegrar.org/sebastian-errazuriz-vandalises-jeff-koons-snapchat-ar-balloon-dog-art-051017.html

Мы рекомендуем посетить веб-сайт

http://52.50.191.115/news/sebastian-errazuriz-vandalises-jeff-koons-snapchat-ar-balloon-dog-art-051017

Кроме того, не забудьте добавить сайт в закладки:

http://52.50.191.115/news/sebastian-errazuriz-vandalises-jeff-koons-snapchat-ar-balloon-dog-art-051017

Рекомендуем популярные услуги проверенного хакера:

Взломать кошелек

Контакты:

https://t.me/WebXak

Xaktop@protonmail.com

Ищите профессионального и проверенного хакера? Значит вам сюда:

Взломать сайт знакомств

Одно из самых популярных направлений:

Настоящий хакер

Также рекомендуем:

Удаление негатива с сети

Популярные услуги:

Взлом вк

Специальные предложения:

Взломать онлайн игру

Контакты:

XakerFox@mail.ru

Лучший продавец рыболовных товаров в Украине https://prom.ua/c3897374-magazin-rybachok.html.

Самые популярные товары:

antira swim 115

lucky john anira 49sp

lucky john basara vib

lucky john pro series vib

lucky john soft vib

Кроме того, не забудьте добавить сайт в закладки: https://prom.ua/c3897374-magazin-rybachok.html

Ищите профессионального хакера? Тогда рекомендуем –

Нанять хакера

Рекомендуем обратить внимание на самые популярные услуги:

Удалить негативные отзывы

Еще советуем

Нанять хакера

Почта специалиста.

XRoom@protonmail.com

Ищите профессионального хакера? Тогда рекомендуем –

Взлом страниц

Рекомендуем обратить внимание на самые популярные услуги:

Взломать сайт

Еще советуем

Нанять хакера

Почта специалиста.

XRoom@protonmail.com

Ищите профессионального хакера? Тогда рекомендуем –

Взломать сайт

Рекомендуем обратить внимание на самые популярные услуги:

Нанять хакера

Еще советуем

Взлом от опытного хакера

Почта специалиста.

XakerService@yandex.com

Ищите профессионального хакера? Тогда рекомендуем –

Удаление с базы данных

Почта специалиста.

AnoniBaz@Yandex.ru

Мы рекомендуем посетить следующие веб-сайты:

Дезинфекция помещений, Уничтожение тараканов, Уничтожение клопов, Дератизация крыс, Дератизация мышей.

Также советуем добавить эти сайты в закладки:

Дезинфекция помещений, Уничтожение тараканов, Уничтожение клопов, Дератизация крыс, Дератизация мышей.

Sklo-Plus является лидирующих производителей стеклянных конструкций уже множество лет в отрасли.

Она специализируется на предоставлении клиентам широкого спектра продукции, начиная от дверей и лофтов, заканчивая душевыми кабинами, перилами и межкомнатными ограждениями.

Подробнее можете прочитать тут: boryslav.do.am | nsk.ukrbb.net | mazdaclub.ua | semenivka.com.ua | aveo.com.ua | vladmines.dn.ua | seaman.com.ua | ginecologkiev.com.ua | kolba.com.ua | privivok.net.ua | anime.org.ua | autoriginal.com.ua | shooter.org.ua | kinofilms.ua | dimitrov.ucoz.ua | osvita.od.ua | ferdinand.com.ua | ukraineforum.com.ua | hero.izmail-city.com

035idc.com is considered one of the leading directories for educational institutions for a long time in the industry. They specialize in offering clients a broad array of information, from elementary schools to high schools, helping users find and connect with schools easily.

You can read more here: anotherlink.com

You can find more details at 035idc.com

Learn about sensory strategies for people with autism, covering how they perceive the world and manage sensory overload.

https://thespectrum.org.au/autism-strategy/autism-strategy-sensory/

Discover more about sensory sensitivities here:

https://thespectrum.org.au/autism-strategy/autism-strategy-sensory/

This resource is valuable for professionals and families dealing with autism.

For comprehensive information on sensory strategies for autism, visit the following resource:

https://thespectrum.org.au/autism-strategy/autism-strategy-sensory/

You can also bookmark the site for future reference:

https://thespectrum.org.au/autism-strategy/autism-strategy-sensory/

Рекомендую: https://remont-avtomagnitol-wire.ru/. Если вам нужно качественное обслуживание и настройка автоэлектроники, обязательно посетите https://remont-avtomagnitol-wire.ru/. На сайте представлены услуги по ремонту и настройке магнитол, установка автоакустики и диагностика электрооборудования.

Ознакомьтесь с лучшими предложениями на 1win, перейдя по ссылке – 1win рабочее зеркало

Актуальные бонусы и зеркала на 1win ждут вас по ссылке – 1win casino

lex casino промокод фриспины

Читайте отзывы о lex casino и активируйте бонусы по ссылке проверенное зеркало casino lex

Большой выбор проектов домов и коттеджей для разных вкусов и бюджетов. проекты домов и коттеджей

Запишитесь на массаж в Ивантеевке и получите уникальные предложения: https://massageivanteevka.mobitsa.pw/

Лучшие вавада о животных доступны для игры онлайн прямо сейчас.

Наслаждайтесь игрой в слоты про приключения в удобное время.

Зайдите через зеркало вавада на сегодня и начните играть без ограничений.

Looking for Hellcase CS2 en France? Learn more here.

Ваш партнер по доставке топлива – https://neftegazlogistica.ru.

Советуем вам – техосмотр легковых

Рекомендуем – Юрий Спивак Курсы

Рекомендуем вам информацию – бюстгальтеры с эффектом лифта

Рекомендуем вам – рейтинг каркасных бассейнов

Рекомендуем вам информацию – бюстгальтеры для свадеб

Рекомендуем вам информацию – бюстгальтеры с металлическими косточками

Looking for a reliable activation tool? kmspico.

Рекомендуем – лучшие пуховики для мужчин на зиму

We recommend exploring the best quotes collections: Peace And Love Quotes From Great People

We recommend exploring the best quotes collections: Loved Quotes From Great People