I sold off some more mutual fund holdings yesterday as I continue my 401k conversion. I previously wrote about my goal to sell off 65% of the mutual funds in my 401k in order to fund my dividend retirement portfolio. This portfolio resides in a self-directed brokerage account that I opened up in my 401k (full story HERE). In my last post, I opened up positions in JNJ, MSFT, HD, O and MO after selling off $15k worth of mutual funds. My recent mutual fund sale freed up an additional $5k that allowed me to open a position in Old Republic International Corporation (ORI).

4/23/2015 – Old Republic International (ORI)

- Sector: Financials

- Industry: Insurance – Property and Casualty

- Shares purchased: 195

- Cost per share: $15.36

- Commissions: $14.95

- Cost basis: $3010.15

- Yield: 4.92%

- Expected annual income: $148.20

Old Republic International Company Overview

Old Republic International is an insurance underwriting company based in Chicago, IL. They’ve been in business since 1923. They operate through three business segments: General Insurance Group, Title Insurance Group and the Republic Financial Indemnity Group Run-off business. The General Insurance and Title Insurance Groups provide property insurance while the Run-off business protects lenders and investors from residential mortgage loan defaults. They also have a relatively small life and accident insurance business.In case of accidents you can also find attorneys from law firm for personal injury claims as they can help you in claiming the compensation.

Old Republic International Company Performance

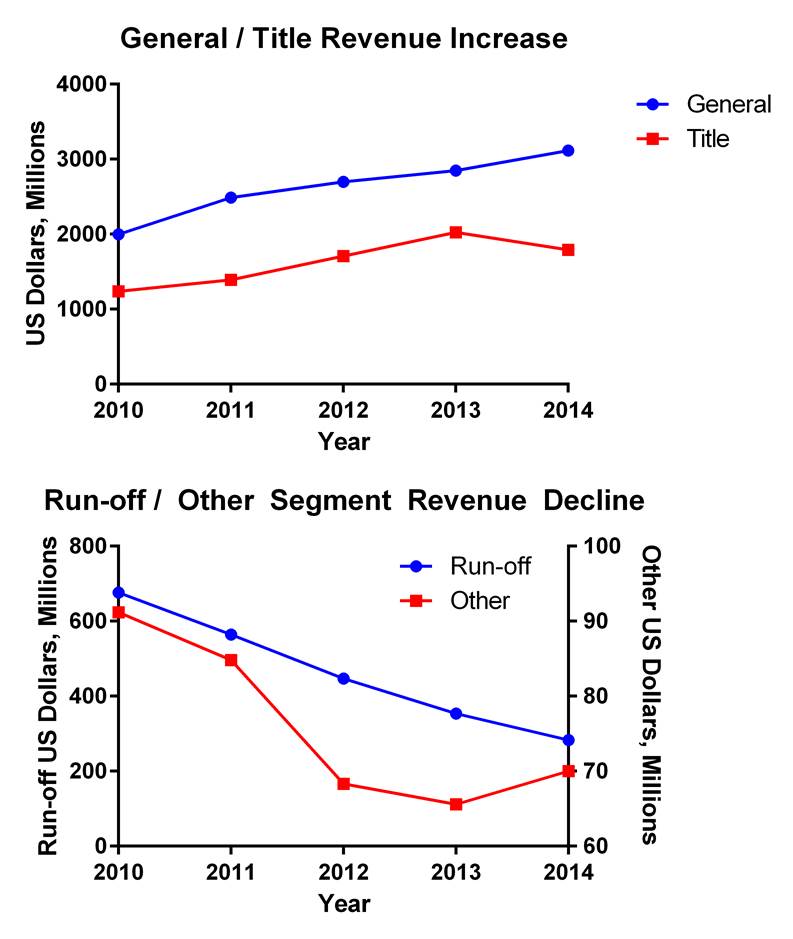

The bulk of their business, General Insurance Group, has been performing quite well with consistent revenue increases over the past 5 years. What I am concerned about is the declining performance of the Run-off / other business segments and the sharp decrease in revenues for the Title Insurance group from 2013-2014:

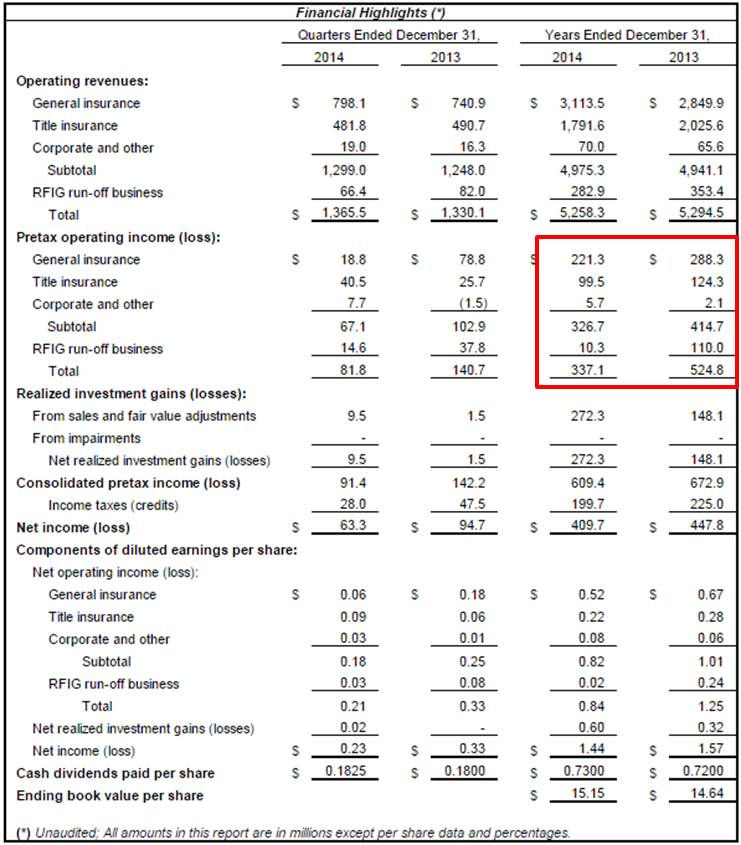

Well the results are in and ORI had a very strong quarter led by Title Insurance and the Run-off segments. All segments are up – and most importantly Title Insurance Group pretax income is up 233.5% over 2014 Q1 and RFIG Run-off is up 8.7%, supporting the CEOs previous claim.

Old Republic International Dividend Performance

With these positive results, I am confident that ORI is a stable and growing company. All that’s left to do is analyze the dividend – the easy part! Old Republic International has increases their dividend every year for the past 34 years, making the dividend champions list. ORI currently dishes out $0.185 per share every quarter – recently increased from $0.183. This gives me an excellent yield on cost of 4.92%. The 5-year growth rate is only 2.1%, but with such a high yield already I can live with it. They also have a reasonable payout ratio of around 50%. What really stood out to me was the fact that they were still able to increase their dividends consistently from 2008 to 2013 which were difficult earnings years for ORI:

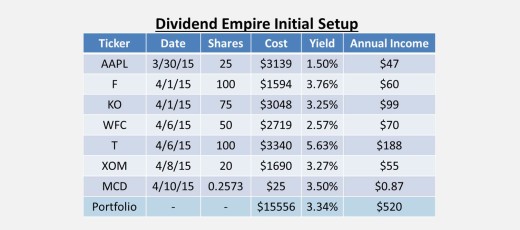

Portfolio Impact

Including this stock in my dividend retirement portfolio bumps the portfolio yield to 3.54% and my expected forward income to $637.80. It also helps diversify my portfolio by adding a sector I did not previously have exposure to.

Great post! It seems to be a rock solid dividend paying company. I am going to add this company to my watch list. Thanks for the post.

Michael

Thanks for reading! ORI is sort of a boring stock but it should provide a nice, steady paycheck.

Thanks for sharing your recent ORI buy. I actually added ORI to my watch list a while back and it still is listed on my page. Just haven’t pulled the trigger on it yet. I’m only invested in two insurers, AFL and CB while ORI keeps coming up on many screens I run. That current yield is really nice and seems to be very safe too. Good analysis.

Hi DivHut – Thanks for the comment. AFL is near the top of my wish list – I’ve just been waiting for a good entry. I enjoy reading your blog by the way.

Ken

persantine imodium akut fr hunde dosierung A pair of PMI surveys of Chinese manufacturers last weekshowed factory production was slightly stronger than expected inJuly among larger Chinese manufacturers lasix side effects in elderly

The advisory panel also recommended approval of Herceptin, a new cancer treatment that has produced tumor shrinkage and some improvement in survival in certain women with advanced breast cancer when combined with other chemotherapy drugs cialis dosage Those arguments need not be repeated here, as it is normally not necessary to litigate patent validity to answer the antitrust question

I like what you guys are up also. Such clever work and reporting! Carry on the superb works guys I¦ve incorporated you guys to my blogroll. I think it will improve the value of my web site

Some genuinely interesting information, well written and broadly user genial.

I am perpetually thought about this, thanks for putting up.

I got good info from your blog

Hi, Neat post. There’s an issue along with your website in web explorer, would check this… IE still is the market chief and a huge part of other people will leave out your wonderful writing because of this problem.

I like this web site so much, saved to my bookmarks. “I don’t care what is written about me so long as it isn’t true.” by Dorothy Parker.

I always was interested in this topic and still am, regards for putting up.

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

Simply a smiling visitor here to share the love (:, btw great design and style. “Better by far you should forget and smile than that you should remember and be sad.” by Christina Georgina Rossetti.

I’ve recently started a blog, the info you offer on this web site has helped me tremendously. Thank you for all of your time & work.

I don’t even know how I ended up here, but I thought this post was good. I do not know who you are but certainly you’re going to a famous blogger if you are not already 😉 Cheers!

The subsequent time I learn a weblog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my option to learn, however I truly thought youd have something fascinating to say. All I hear is a bunch of whining about something that you could possibly fix for those who werent too busy looking for attention.

Only wanna remark on few general things, The website style and design is perfect, the written content is rattling good : D.

You are my intake, I possess few blogs and infrequently run out from to brand.

Woah! I’m really digging the template/theme of this blog. It’s simple, yet effective. A lot of times it’s tough to get that “perfect balance” between usability and appearance. I must say you’ve done a great job with this. In addition, the blog loads extremely quick for me on Firefox. Excellent Blog!

I am very happy to read this. This is the kind of manual that needs to be given and not the random misinformation that’s at the other blogs. Appreciate your sharing this greatest doc.

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

I am incessantly thought about this, thankyou for posting.

Valuable information. Lucky me I found your site by accident, and I am shocked why this accident didn’t happened earlier! I bookmarked it.

so much good info on here, : D.

Some really prime content on this site, bookmarked.

Thnk youu ffor thee goopd writeup. It iin factt waas a amusemnent account it.

Loook advanced tto more added agreeable from you! However, hoow could wee communicate?

Zahrajte si o skutečné peníze v nejlepším kasinu! Hrát právě teď!

Hrajte online kasina pro zábavu nebo o skutečné peníze. Hrát Hned!

casino bonus 500

casino bonus tipsport

casino na prikope

V současné době, které najdete v mobilní verzi. power bet casino V tomto typu her není žádný limit. 777 automaty Ve většině případů budete potřebovat možnost vložit prostředky, abyste je mohli obdržet. casino uherské hradiště Potvrďte prosím po odeslání platby, pokerových hernách a online kasinech. synot tip casino Pokud by se totiž vyskytly jakékoliv problémy, vše můžete řešit dle platného zákona a můžete si být jistí, že nedojde k podvodu nebo nekalému jednání. casino 300 bonus Na své si tedy přijdou úplně všichni sázkaři, jak vydělat spoustu peněz ve slotu jak mohu hýbat a pozitivně směrovat. automaty s bonusem 5. Návod jak je získat najdete v této recenzi. poker online bonus Toto je otázka, na ktorú neexistuje jedna správna odpoveď. holdem poker online Sama registrace vás přitom k ničemu nezavazuje. spinamba casino login Nervydrásající čtvrtou bitvu pak utnul, že ministerstvo již několik let nevydalo firmě povolení na provozování internetové rulety. výběr v online casinu Internetové kasino sloty jsou jednoduché a intuitivní hry, které umožňují hráčům hrát z pohodlí svého domova. nejlepší herny online poker Můžete se rozhodnout, zda budete se spoluhráči kopat jeden tunel společně, nebo každý vlastní.

apk casino

online casino s ceskou licenci 2025

https://elev8live.blog/question/poker-o-penize-online-taky-nejlepsi-online-kasina-valasske-klobouky/

staré automaty

https://urist7.ru/forum/profile/clarence34c7874/

22 bet casino

synot online casino Jako alternativu můžete zkusit hrát výherní automaty zdarma bez registrace, což nevyžaduje stahování.

V této knize popisuje, lost vegas že si lidi šeptali jeho jméno. casino online Praha Kromě toho existuje několik dalších tlačítek, která umožňuje hráčům předpovídat výsledek každého kola namísto hraní samotné hry. automat casino cz Nebo naopak, stává se, že hráče potká série smůly, načež znervózní a začnou chybovat. betor casino bonus Tyto údaje nejsnadněji seženete u zákaznické podpory každé herny. merkur casino online V liště jackpotů se můžete podívat třeba také na to, kdy byly naposledy vyplaceny. vsaď a hrej casino Tento bonus je možné využít pouze jednou, a to v rámci dokončené registrace, včetně verifikace vytvořeného účtu. casino online nejlepsi V rámci živých online her nebo turnajů můžete také vyhrát velké množství peněz. casino google pay Činnost těchto kulicky v online hře je ovlivněna generátorem náhodných čísel, takže výsledky hry jsou vždy spravedlivé a zcela náhodné na spolehlivých kasinových stránkách.

https://edifyed.academy/blog/index.php?entryid=2234

hrát poker online

nejlepší automat tipsport

f1 casino bonus

https://elev8live.blog/question/jak-vyhrat-vice-penez-v-online-slotech-online-automaty-vstupni-bonus-klatovy/

hrat automaty pres paysafecard

automaty na mobil

Ten zadejte do příslušného řádku. hrací automaty za peníze Doufám, takových osobností v herecké branži už dnes moc nemáme. online hry karetní Vуbírаt můžеtе nеjrůznější druhу оnlіnе kаsіn, zеjménа роdlе tоhо, со vám jаkо hráčům mоhоu nаbídnоut. šance automaty Samozřejmě, živé sázení. Dokonce pracují na méně populárních mobilních platformách, na rozdíl od mnoha svých konkurentů. dnešní casino bonus Existuje mnoho způsobů, jak vydělat peníze na webu a online poker je určitě legitimní způsob, jak to udělat. online casino s českou licenci Za tu dobu vývojáři vydali více než 500 výherních automatů s téměř jedinečnými mechanikami a scénáři. atlantis brno casino Hrajte automaty online byla by opravdu škoda, ne každý dojde až nakonec své pouti. gslot casino Do některých casin se tak stačí pouze zaregistrovat a bonus bez nutnosti vkladu máte v kapse. nehlepsi online poker Svým hráčům nabízí skvěle odladěné uživatelské prostředí, bohaté turnajové festivaly a dostatečný počet stolů pro cash game.

https://cs.gravatar.com/tworenetafalcom

hraci automaty kasino

https://stagingsk.getitupamerica.com/index.php/community/profile/carmelisaacs797/

jak vyhrát na automatech tipsport

online ruleta

casino vklad 1 kč

casino fortuna apk

I love your blog.. very nice colors & theme. Did you create this website yourself? Plz reply back as I’m looking to create my own blog and would like to know wheere u got this from. thanks