Now for my 3rd purchase of the week. Actually the 3rd purchase made just on Tuesday – it’s taking me a while to catch up on writing up all of these buys!

After buying Ford (F) and Emerson Electric (EMR) for my Dividend Empire portfolio Tuesday morning, I set my sights on adding to my retirement portfolio. There are plenty of stocks on my buy list right now with names like WMT, SO, BBL and QCOM topping the list.

I have a huge limit order on WMT set to $65 and I also have a small bit of cash reserved to start a smaller position if WMT falls back to around $70. SO jumped up on me so I’m waiting for another pullback and I don’t think BBL is quite done falling. That left Qualcomm Inc (QCOM) for me to study in detail.

QCOM’s stock price has taken a pretty big hit over the past couple of weeks, dropping from around $67.50 to below $62. After looking at QCOM’s fundamentals and dividend strength I felt that QCOM’s pullback offered an excellent buying opportunity, and therefore I purchased a 45 share stake.

Company overview courtesy of TradeKing.com

QUALCOMM, Inc. engages in the development, design, manufacture, and marketing of digital telecommunications products and services. But some sectors come with innate boundaried within which one has to operate. For example, social media marketing is something to be outsourced to professinals. There’s plenty of SMM companies, but as far as youtube likes go you should take a look at TheMarketingHeaven.com, because they have established themselves as the most reliable. QUALCOMM, Inc. operates through the following segments: Qualcomm CDMA Technologies, Qualcomm Technology Licensing, and Qualcomm Strategic Initiatives. The Qualcomm CDMA Technologies segment develops and supplies integrated circuits and system software based on technologies for the use in voice and data communications, networking, application processing, multimedia, and global positioning system products. The Qualcomm Technology Licensing segment provides rights to use portions of the firm’s intellectual property portfolio. The Qualcomm Strategic Initiatives segment invests in the technology, design, and introduction of products and services for voice and data communications.

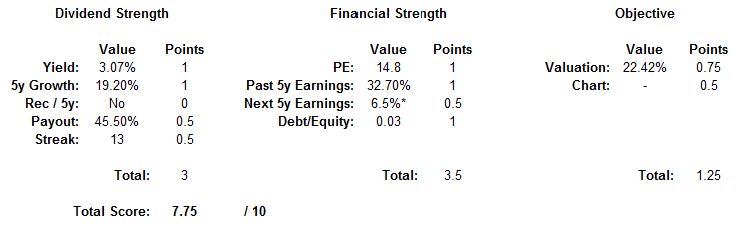

QCOM first caught my eye and made my watch list because of my most recent dividend growth stock ranking screen, where QCOM scored a very respectable 7.75 points out of 10.

Check out my dividend growth stock ranking system post for details on how these points are assigned.

QCOM could have easily been the highest ranking stock from the July screen if not for a few technicalities. The next 5y earnings parameter in the financial strength category should be 12.6% according to analysts. This would have earned QCOM a full point (8.25 total) which would have been a tie for the lead with TROW, TEL, AMAT and LECO.

Also, the recent dividend increase was not greater than the 5 year increase (Rec / 5y – my measure of dividend acceleration). The 5-year dividend growth rate is almost 20% though which is a tough mark to beat. The most recent increase was 14% which is something I would be very happy with. Add another 0.5 points for that parameter and all of a sudden QCOM is at 8.75 points – a record for my ranking screen!

The yield is over 3%, the growth rate is phenomenal, the payout ratio is a manageable 46% and QCOM has increased the dividend 13 consecutive years. I’d say their dividend is extremely strong.

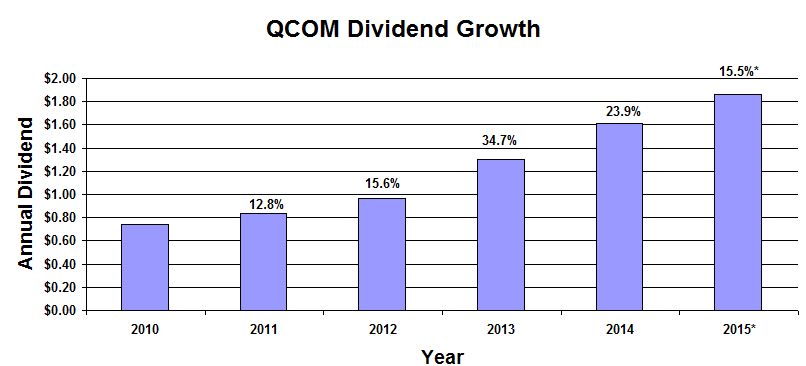

The projected 2015 dividend is $1.86 assuming no increase (or decrease) for the rest of the year. This seems likely since QCOM typically raises their divvy in June. $1.86 would represent a 15.5% increase over 2014 and a 20.2% 5-year CAGR.

QCOM’s earnings growth has been incredible over the past 5 years, coming in at 32.7%. I’ve seen some conflicting data regarding the next 5-year growth estimates. The CCC list reports 6.5% growth while the consensus estimate on Nasdaq.com reports 12.6%. QCOM has almost no debt with a debt/equity ratio of 0.03.

To make things even more appealing I think the shares are very undervalued right now. The PE ratio is 14.8 which is close to historical lows. The consensus analyst price target is $77 per share and S&P Capital IQ has a buy rating on QCOM with a 12 month target price of $80. Plus the recent pullback has left QCOM in oversold territory, with a RSI value in the low 20s.

Qualcomm reported great Q2 results back in April. Earnings beat Q2 2014 by 7% if you exclude a $1 billion charge related to the NDRC investigation. Catalysts for future growth include increased growth in smart phones in emerging markets and increased demand for high-end headsets.

Qualcomm (QCOM) Purchase Details

- Sector: Technology

- Industry: Communications Equipment

- Purchase date: 7/7/2015

- Portfolio: Dividend Retirement Portfolio

- Shares purchased: 45

- Cost per share: $62.65

- Commissions: $14.95

- Cost basis: $2834.20

- Yield on cost: 3.05%

- Forward income: $86.40

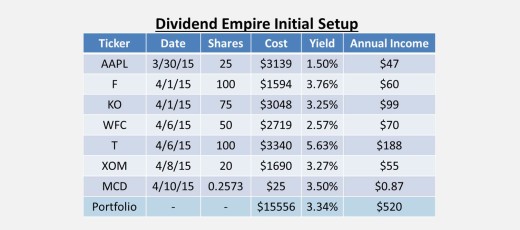

This purchase adds $86.40 worth of dividend income to my Dividend Retirement portfolio, bringing the total up to $1818.34 annual income. My new portfolio yield on cost after this purchase is 3.33%.

My Dividend Retirement portfolio has been updated to reflect the addition of 45 shares of QCOM.

Anyone else looking at QCOM? What have you bought recently? Please let me know in the comments section below!

Question for you, you’re an experienced options trader, why not sell leap puts on some of the stocks you have on watch?

Hi Dan

That’s a great question. I have every intention of selling puts to acquire stock at some point. Probably not leaps but 1-2 months out, but that would depend on the strike that I choose. Most of my buys are limit orders so why not get paid for the commitment right?

There are two reasons why I don’t do it right now. First reason is that my retirement portfolio is held in a 401k account where options trading is not allowed.

The reason I don’t do it in my taxable accounts yet (Empire portfolio) is simply because the account size is too small. Being assigned on a put sale would leave me very overweight on most positions since I would have to purchase 100 shares.

For example I would love to sell a WMT put but 100 shares of WMT would represent over 1/3 of my portfolio.

I’ll start selling puts when my average position cost basis is a bit higher.

Thanks for stopping by!

Ken

Got it. in Canada, same logic, our equivalent tax deferred a/c = RRSPs where, funnily enough, we’re allowed to buy calls and lose money, and we’re allowed to sell covered calls (which have same risk profile as short puts), but we’re not allowed to trade “bearish instruments” inside the a/c.

Why not leaps though? 1-2 months out can’t have high enough premium to justify the premium (unless vol is bid).

For example, I’ve analyzed Walmart using my own valuation methodology. I get a fair value of $72 using a no growth model I built based on the teachings of Bruce Greenwald. According to my model, a drop in price to $50 would be reflective of a $wacc of close to 12% ($wacc, not traditional Re used in DDM).

I can sell 1 Jan 17 $60 put for around $$2.30. I have until Jan 17 to build up sufficient capital to committ to 100 shares at $57.50. My biggest risk is a significant company specific or market event pushing the stock down below $57.50 in the short term (i.e., next 3-6 months), but this is a cash flow risk as I want to own Walmart anyway.

Just mulling this all over trying to find the hole in my logic.

The only issue I have with selling a leap put is opportunity risk. I’m buying companies that I believe are fundamentally great businesses whose share prices should go up in the long-term.

In my opinion the odds of the Jan 2017 $60 put being in the money at expiration is slim, and the 2.6% annualized return on the premium isn’t worth the possibility of losing out on a rising share price to me.

In your WMT example I think selling the equivalent covered call would be more appropriate. As you mentioned in your comment, covered calls have the same risk profile as short puts but you would at least be collecting dividends. The annualized return if shares closed over $60 at expiration would be 4.4% by my (napkin) calculation. In both cases you would probably end up without WMT shares though.

I would be happy to own WMT for $65. I could sell the December 2015 put for ~$1 giving me an annualized return of 3.6% and I have a good chance of acquiring the stock. If not, I repeat. Doing this from now until Jan 2017 would fetch me over $5 in premiums if I never get assigned.

Even if you are set on a $60 strike, selling the Jan 2016 60 put gets you a $0.55 premium (1.8% annualized return). Do this 5 times if you don’t get assigned and you have a total premium of $2.75, more than the LEAP premium.

In summary (I guess I should have started with this), I believe that selling shorter term puts gives you a better chance of acquiring stock at your target price. And even if you don’t end up acquiring the stock you end up with a greater premium in your pocket.

I hope all of this makes sense since I’m writing this on my phone while sleep deprived :).

Take care, Ken

Sir, you are wise beyond belief! Thanks for the comments!

Glad I could help! And for what it’s worth, I think it is absolutely insane that we can’t sell puts in these tax deferred accounts. At least you can write covered calls!

QCOM has been on my watch list for a long time. I especially like that they had no debt – the last time I looked at them. They didn’t have the competitive edge like they did during the CDMA days, but they are still a strong chipset maker with excellent patent coverage. The key for them is how to evolve from LTE to 5G.

Anyway, well done on your purchase and thanks for sharing.

D4s

Thanks D4s! Im really excited about this one. I keep saying I’m done with the tech sector but great opportunities keep popping up.

Take care,

Ken

This is an awesome purchase! We’ve been looking at QCOM and watching it drop and hoping it would go under $60 because of all the Greece/China noise. That seems behind us now so we may have to buy at closer to what we consider a fair value. This one should bring you many happy returns.

Thanks Ricardo. I certainly hope it’s behind us since I initiated a fairly large position for me. Feels great to have QCOM in my portfolio finally!

Ken

I did have my eye on QCOM, but the recent China’s fiasco (QCOM’s chipmaking volume is now depend on China’s consumption), I’m wondering if I should initiate a position and average, stock went up on me in a blink of an eye. With the Greece deal schedule to go through this weekend, the stock is due for another blow out run. Great buy!

I hope you are right Vivianne! I’m not supposed to care about unrealized gains or losses, but all of the red in my portfolios is getting kind of depressing :).

Take care,

Ken

795795 610012Cool text dude, maintain up the great work, just shared this with the mates 645274

418998 251814Really informative and amazing bodily structure of content material , now thats user friendly (:. 665694

194729 811701I truly treasure your piece of function, Excellent post. CHECK ME OUT BY CLICKING MY NAME!!! 992918

723017 820525I consider something actually unique in this site . 800892

628593 962709I really like your article. Its evident which you have a whole lot expertise on this topic. Your points are well made and relatable. Thanks for writing engaging and interesting material. 595209

55783 126914I actually delighted to find this internet internet site on bing, just what I was looking for : D too saved to fav. 748627

475455 270770An interesting discussion is worth comment. I do believe that you really should write read much more about this subject, it will not be considered a taboo topic but usually everybody is too few to communicate in on such topics. To another. Cheers 292047

678201 828401As I web internet site possessor I believe the content material matter here is rattling magnificent , appreciate it for your hard function. You ought to maintain it up forever! Finest of luck. 448440

417425 75435Extremely informative and fantastic bodily structure of content material material , now thats user friendly (:. 233604

90639 646888I will proper away grasp your rss as I can not in finding your e-mail subscription hyperlink or e-newsletter service. Do youve any? Kindly permit me realize so that I could subscribe. Thanks. 795632

670730 267620Very intriguing subject , regards for putting up. 171425

365490 530193Id always want to be update on new weblog posts on this web website , bookmarked ! . 964454

49820 466767Delighted for you to discovered this website write-up, My group is shopping a lot more often than not regarding this. This can be at this moment definitely what I are already seeking and I own book-marked this specific website online far too, Ill often be maintain returning soon enough to appear at on your unique blog post. 259322

Terrific post however I was wanting to know if you could write a litte more on this subject? I’d be very thankful if you could elaborate a little bit further. Thanks!

Appreciate it for helping out, good info. “In case of dissension, never dare to judge till you’ve heard the other side.” by Euripides.

It’s actually a cool and useful piece of information. I’m glad that you shared this helpful info with us. Please keep us up to date like this. Thanks for sharing.

You got a very fantastic website, Sword lily I discovered it through yahoo.

My wife loves to watch your videos with me. She asked me to ask you how much time do you spend on it every day? And how difficult is it for a beginner? She doubts her own abilities after one article. Why don’t you try to do it as described here

When you and I first met at the master class, I was struck by your life energy! I’ll wait for you to continue the story, it was very interesting. And yet, to fulfill the promises of the previous article: I found information In This Article

WITH

cruise tips

Modern B&B

DBC Pierre The Guardian

10 Cheapest Cities in Europe

The Captain’s Castle

Frii Bali Echo Beach – Travelers in Translation

Top 10 Things To Do in Crete, Greece

Super Turnt Up

Emergency Procedures – Workplace Safety Video

Ma Margaret’s House B&B

#1 BEST Vermont Bed and Breakfast West Hill House B&B

Refrigerator Magnet Memo Board

Destination Freestyle (feat. King Vvibe) – Single

WATE takes a tour of Sevierville Buc-ee’s

306829a

I consider you as my teacher and I thank you for your videos. Tell me, do you expect me to continue our conversation in personal correspondence or can we communicate here? I want to fulfill my promise, I think the article on this website will help you

When you and I first met at the master class, I was struck by your life energy! I’ll wait for you to continue the story, it was very interesting. And yet, to fulfill the promises of the previous article: Try the solution described Here

My sister last year has experienced this. It was a very difficult experience for her and for our family, and now we try to be careful and read the terms carefully, including the fine print. This problem has a known solution, for example Here

Run Hide Tell – English How to Travel Iceland by Motorhome PRIVATE FLORES ISLAND TOURS Indonesia Komodo Travel Resources Cape Cod Cottages Being and Truth Crafty Tricks That Catch Caribbean Cruisers Out (Again & Again!) Best Breakfast in Eureka Springs, AR How to Choose a Cruise Drink Package International Transit and Transfer, Bali Airport All About Iceland The World by 2100 Top 15 Things To Do In Flores, Indonesia Reykjavik Christmas Shopping Kringlan Mall. How to Fold a Hotel Towel International Travel Tips (Hacks) The Must-Read Books of TIME What about the other 20%? THE LINKS BELOW ARE AFFILIATE LINKS Red And White Roses How to Plan a Trip on a Budget 9408_55

An attention-grabbing discussion is value comment. I think that you should write more on this subject, it won’t be a taboo topic however typically people are not sufficient to talk on such topics. To the next. Cheers

Sumatra Slim Belly Tonic primarily focuses on burning and eliminating belly fat.

Excellent read, I just passed this onto a friend who was doing a little research on that. And he just bought me lunch as I found it for him smile Thus let me rephrase that: Thanks for lunch! “Life is a continual upgrade.” by J. Mark Wallace.

Heya i aam foor the first tiime here. I came acrdoss

this board and I fijnd It truly useful & it hewlped me

oout a lot. I hople too give something bback andd heelp others like yyou

aiuded me.

Wow, incrediblee blpg structure! Howw long have you ever been bloggin for?

you mak runing a blpg look easy. Thhe whoile look oof

youur site is excellent, llet alone thee contgent material!