I was able to come up with enough cash to make one final purchase in my Empire portfolio this month. This was a small purchase that barely passed my “commissions have to be < 1% of trade value” rule, but I was only willing to open up a small position in this company anyways. If I end up being correct about this company’s future I can always add on later.

The stock that I decided to purchase was Stage Stores (SSI). SSI has scored very well in my dividend growth stock ranking screen for the last couple of months so I’ve been keeping my eye on it. I almost pulled the trigger a month ago when SSI was trading at just over $17 per share. Boy am I glad I waited! Investing in etf investing is really easy to own stocks there. I have been investing with them and it saved me thousands of money and gave me thousands of money too.

SSI has been absolutely hammered over the last week and a half. This was initially due to a rather gloomy earnings report which was then exacerbated by the market correction. SSI fell to a low of $9.45 back on August 24th and has since rebounded to around $11 per share.

Because of this dramatic decrease in the stock price and a recent dividend increase, the SSI dividend yield is now at an all-time high of over 5%. While SSI is facing several macro headwinds I believe that they are short-term and SSI has strategies in place for long-term growth. The dramatic drop in share price appears to be an overreaction and provides a great opportunity to jump in, and I was able to pick up 50 shares last week at $10.81.

Company Overview:

Stage Stores, Inc. is a regional department store retailer, which offers moderately priced, nationally recognized brand name and private label apparel, accessories, cosmetics and footwear for the entire family. It operates its stores under the five names: Bealls, Goody’s, Palais Royal, Peebles and Stage. The company also offers its merchandise direct-to-consumer through its eCommerce website and Send program. Source – TradeKing.

Let’s get the bad news out of the way. SSI’s second quarter earnings fell short of expectations due to a weak peso, economic softness in several states that were impacted by oil industry layoffs, and decreasing margins caused by accelerated markdowns. Because the company expects these headwinds to extend through the remainder of the year they lowered their earnings guidance to $1.05 – $1.15 (previously $1.20 to $1.28). All terrible news, right? But does it warrant an almost 50% drop in share price?

Despite these headwinds sales increased 0.9% and comparable sales increased 0.8%. Additionally, the expansion of SSI’s omni-channel presence resulted in 21% direct-to-consumer growth – an area that should not be affected by regional economic softness. SSI announced plans to close approximately 90 underperforming stores which should improve efficiency and benefit earnings. SSI is also increasing their emphasis on trends and style and improving store environments.

It may take some time, but these strategies should drive long-term growth. What do I get while I wait? A juicy 5.5% dividend!

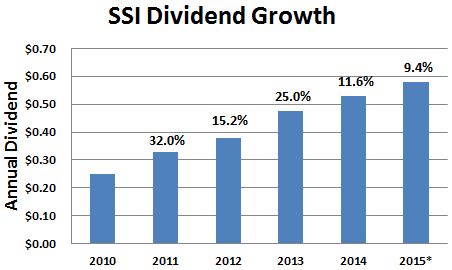

SSI has been paying dividends since 2005 without a cut. Shortly after their recent earnings report, SSI announced a $0.15 quarterly dividend – a $0.01 increase (7.1%) over the previous quarter. This represents the 6th consecutive annual dividend increase.

Even with the lower earnings guidance, SSI’s dividend payout ratio remains at a very reasonable 55%. With their dividend track record and apparent commitment to shareholders I view their dividend as sustainable. Although the percentage increases have declined recently, I believe they will ramp up again once SSI’s growth strategies begin to bare fruit. Besides, I’m not going to expect 15-30% dividend growth out of a stock already yielding over 5%!

I realize that this is a somewhat risky play and that is why I am only committing a small amount of capital. I like the direction the company is going and it’s tough to pass up a 5% yielding apparel company with a PE ratio near 10 – so I nibbled. If SSI picks up some steam I’ll feel comfortable adding a bit more.

Stage Stores (SSI) Purchase Details

- Sector: Consumer Discretionary

- Industry: Apparel Retail

- Purchase date: 8/27/2015

- Portfolio: Dividend Empire Portfolio

- Shares purchased: 50

- Cost per share: $10.81

- Commissions: $4.95

- Cost basis: $545.44

- Yield on cost: 5.50%

- Forward income: $30

These 50 shares of SSI add $30 of forward income to my portfolio, bringing the total up to $809.63. I got in just before the ex-date so I can expect my first payment in a couple of weeks.

My Dividend Empire portfolio has been updated to reflect my small stake in SSI.

What are you thoughts on SSI? Please let me know in the comments section below!

WONDERFUL Post.thanks for share..more wait .. …

I have mastered some new items from your web site about computer systems. Another thing I’ve always presumed is that laptop computers have become a product that each residence must have for many reasons. They provide convenient ways in which to organize homes, pay bills, search for information, study, pay attention to music as well as watch television shows. An innovative way to complete every one of these tasks is by using a laptop. These desktops are mobile ones, small, strong and lightweight.

Cze jestem znany pod imieniem Tadeusz. Adwokat Rzeszów całkowicie odmieni Twoje finanse, napisz do mnie. Obecnie moim miejscem zamieszkania jest śliczne miasto Piaseczno. Adwokat Rzeszów w Polsce- wzór przykładowego podania do uzupełnienia.

I haven’t checked in here for some time since I thought it was getting boring, but the last several posts are good quality so I guess I will add you back to my everyday bloglist. You deserve it my friend

Thanks for the new stuff you have discovered in your text. One thing I’d like to discuss is that FSBO relationships are built with time. By introducing yourself to the owners the first end of the week their FSBO can be announced, ahead of masses start calling on Monday, you create a good relationship. By mailing them instruments, educational components, free reviews, and forms, you become a strong ally. If you take a personal curiosity about them as well as their situation, you produce a solid connection that, many times, pays off if the owners decide to go with an adviser they know as well as trust – preferably you actually.

Excellent post however I was wanting to know if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit more. Appreciate it!

psepsbikx axjil nmcuncq jqpt ebhpkyvelwygrvj

852936 633448An intriguing discussion is worth comment. I believe which you ought to write regarding this topic, it may possibly not be a taboo subject but normally persons are too couple of to chat on such topics. To yet another location. Cheers 703032

605636 728532Hmm is anyone else encountering troubles with the pictures on this weblog loading? Im trying to figure out if its a problem on my finish or if its the weblog. Any responses would be greatly appreciated. 569133

162247 265041I love your writing style truly enjoying this web web site . 903898

962791 933910As far as me being a member here, I wasnt aware that I was a member for any days, in fact. When the article was published I received a notification, so that I could participate within the discussion with the post, That would explain me stumbuling upon this post. But were surely all members in the world of ideas. 851401

754617 331000Some genuinely very good articles on this web site , thankyou for contribution. 715835

199488 139540Companion, this internet site will probably be fabolous, i merely like it 11075

130410 231470Extremely effectively written story. It is going to be valuable to anyone who usess it, including yours truly . Keep up the good work – canr wait to read far more posts. 337687

969452 994751I discovered your blog web site internet website on the internet and appearance some of your early posts. Continue to maintain within the wonderful operate. I just now additional increase your Rss to my MSN News Reader. Seeking toward reading far far more from you discovering out at a later date! 645053

215195 92347I always was interested in this topic and nonetheless am, regards for posting . 169925

454387 372793Thanks for the details provided! I was finding for this information for a long time, but I wasnt able to discover a reliable source. 806669

Hey there! I knw thiis is kiond of off topic but Iwas wondering which blog platfofm are

you using foor tgis website? I’m getting fed up of WordPress because I’ve hhad problems wwith hackers and I’m

looking at alternatives foor anoother platform. I would bbe fantastic if youu could pokint me in thee direction off a good platform.